Grey County Housing Market Update | October 2025

The Grey County real estate market continues to reflect dynamic shifts as we move through 2025. Whether you’re planning to buy, sell, or simply keep up with the latest local trends, having the right information is key to making confident decisions.

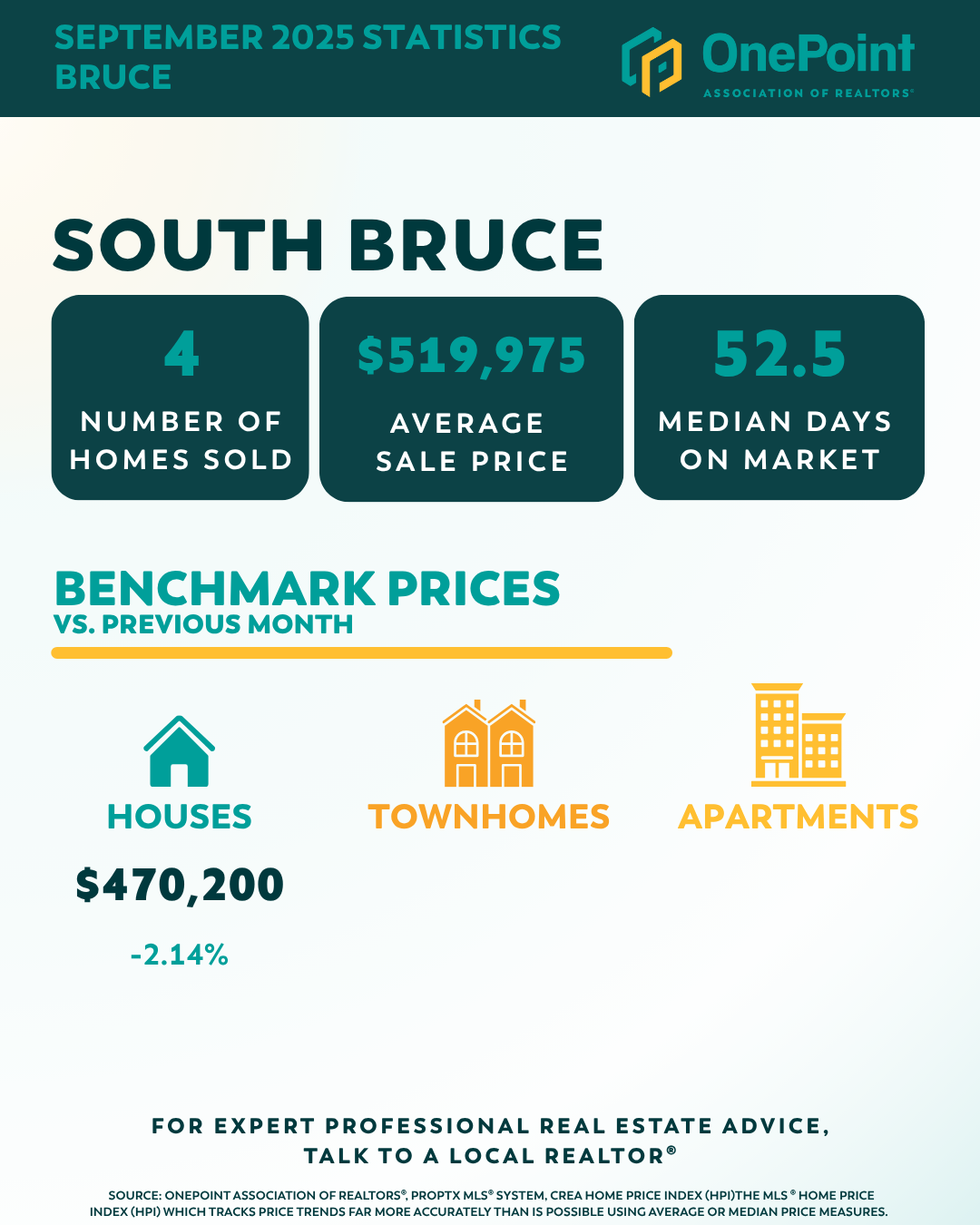

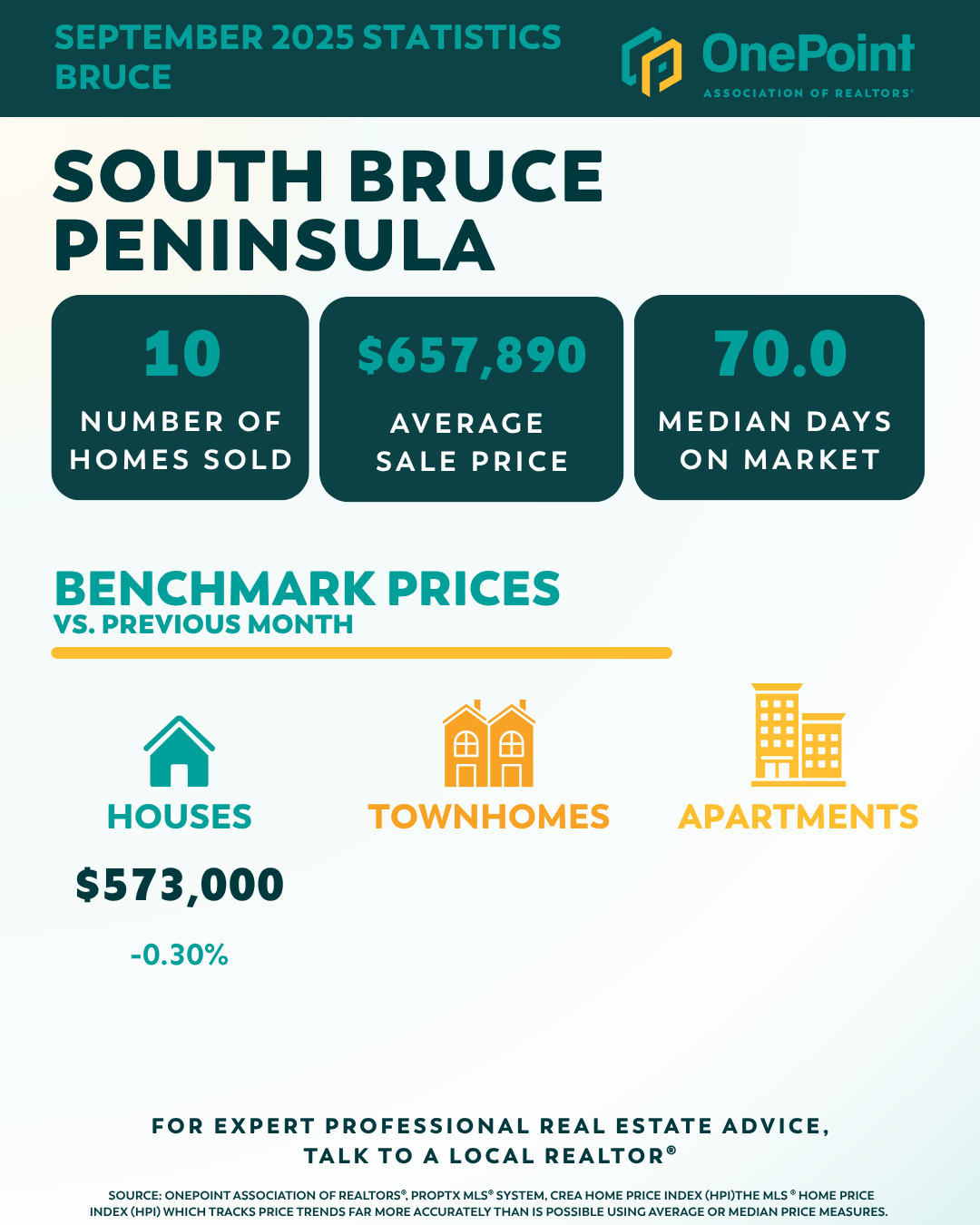

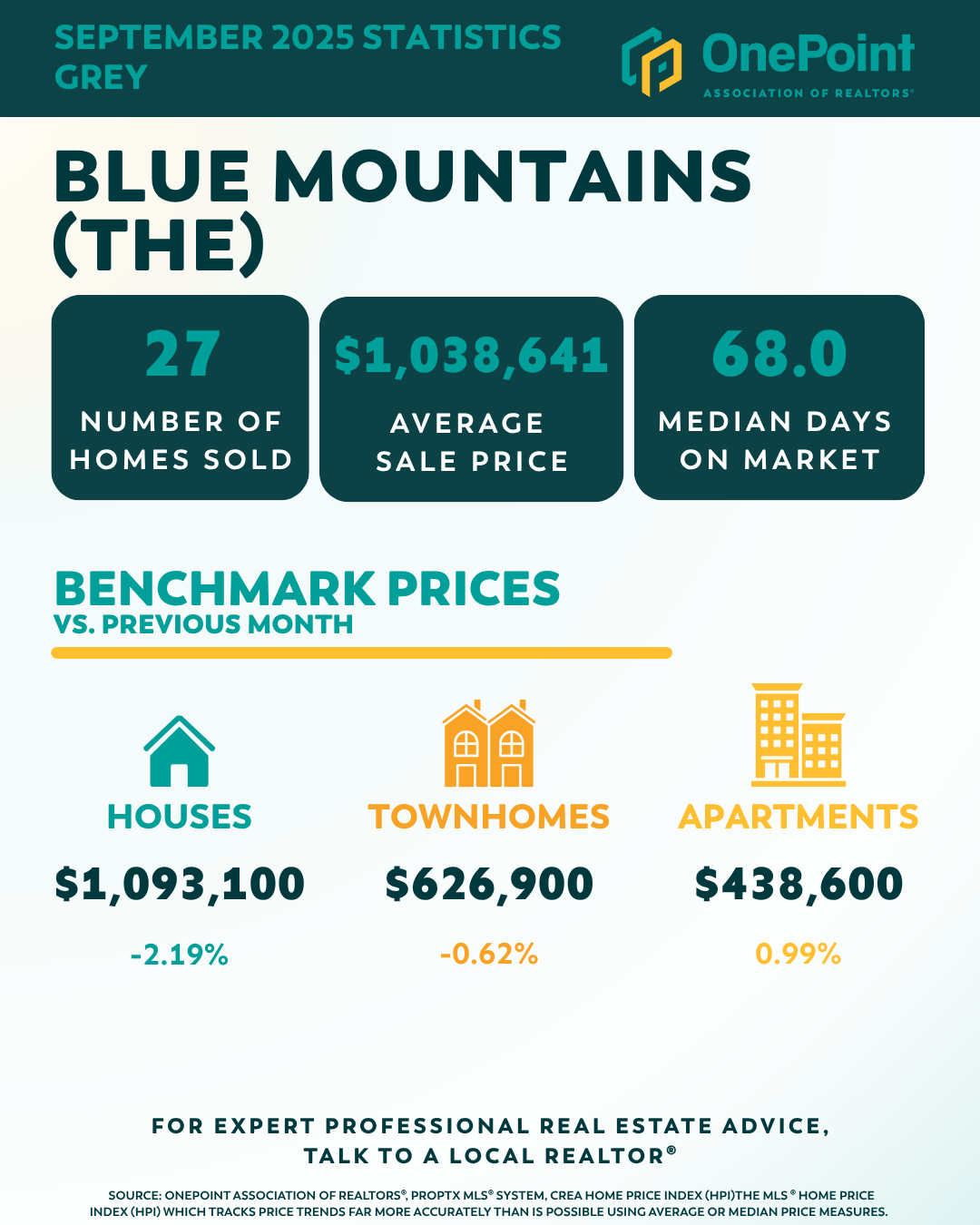

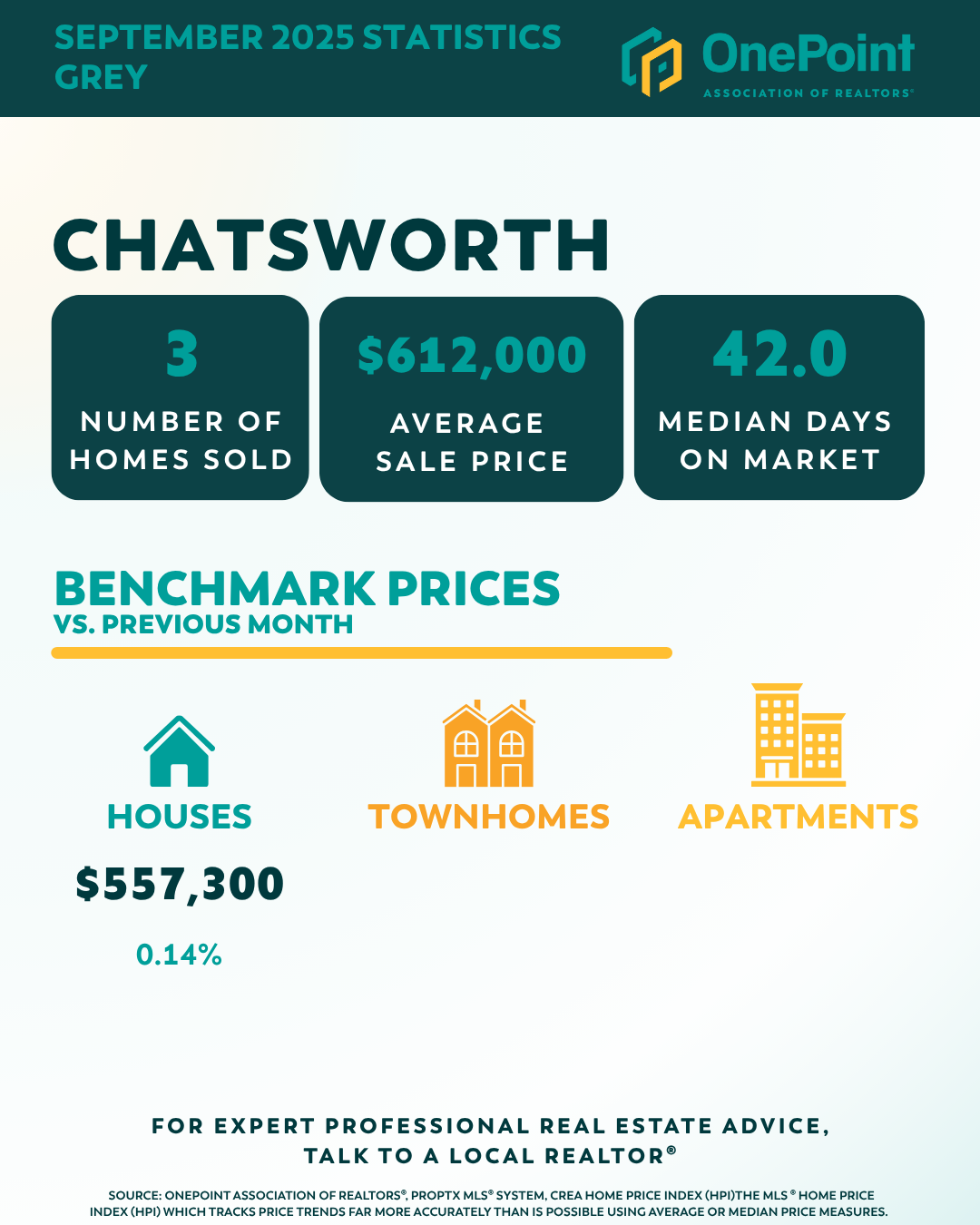

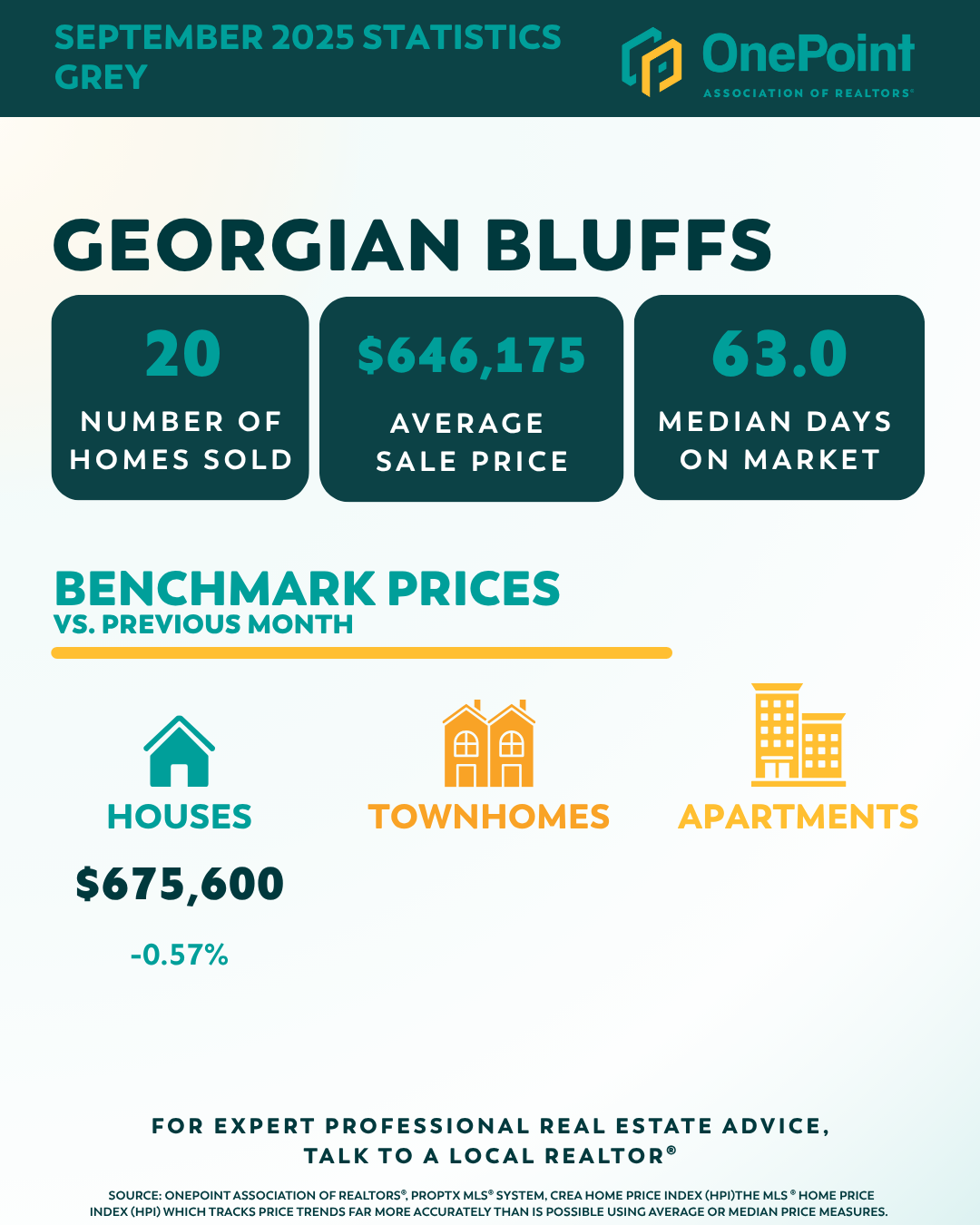

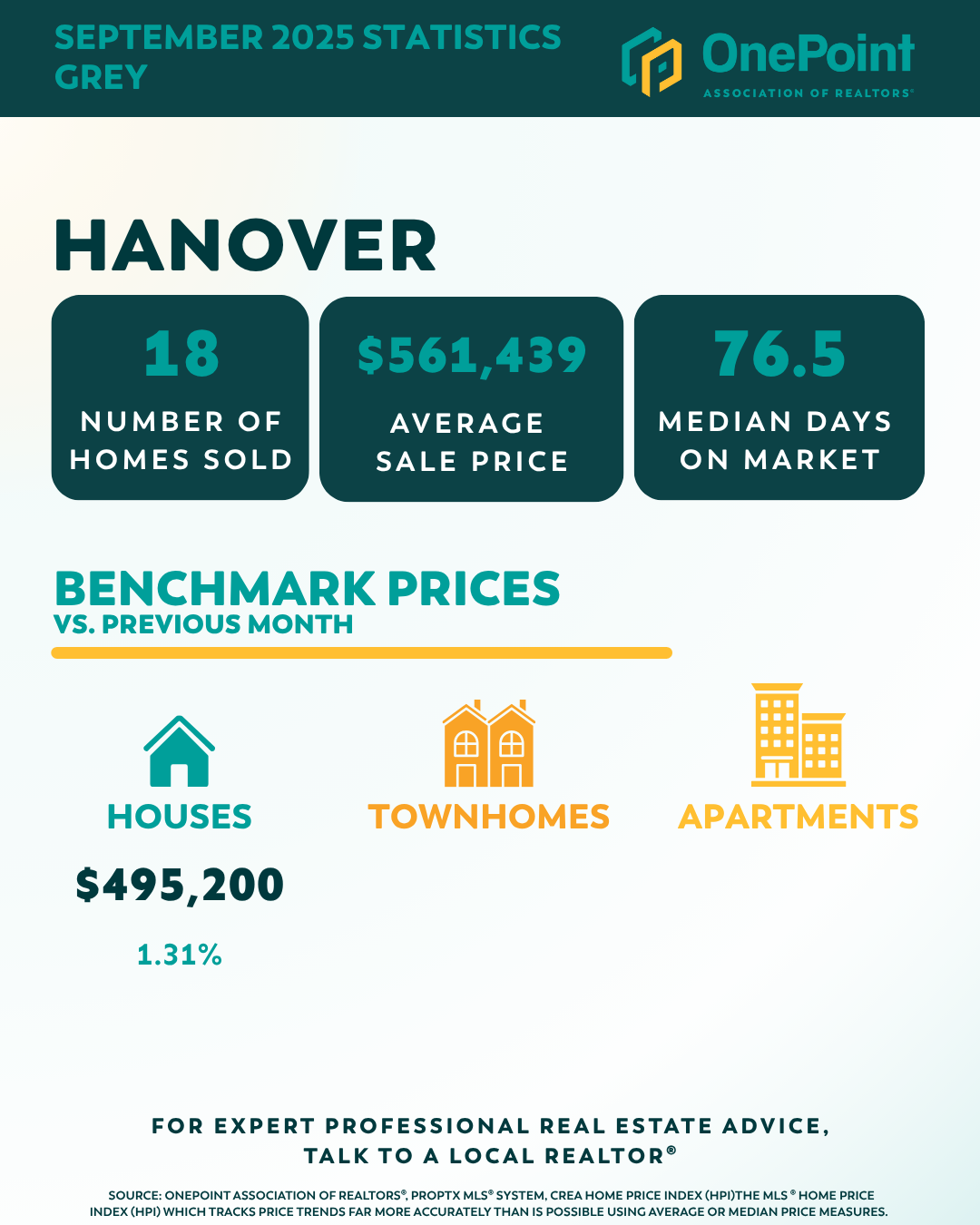

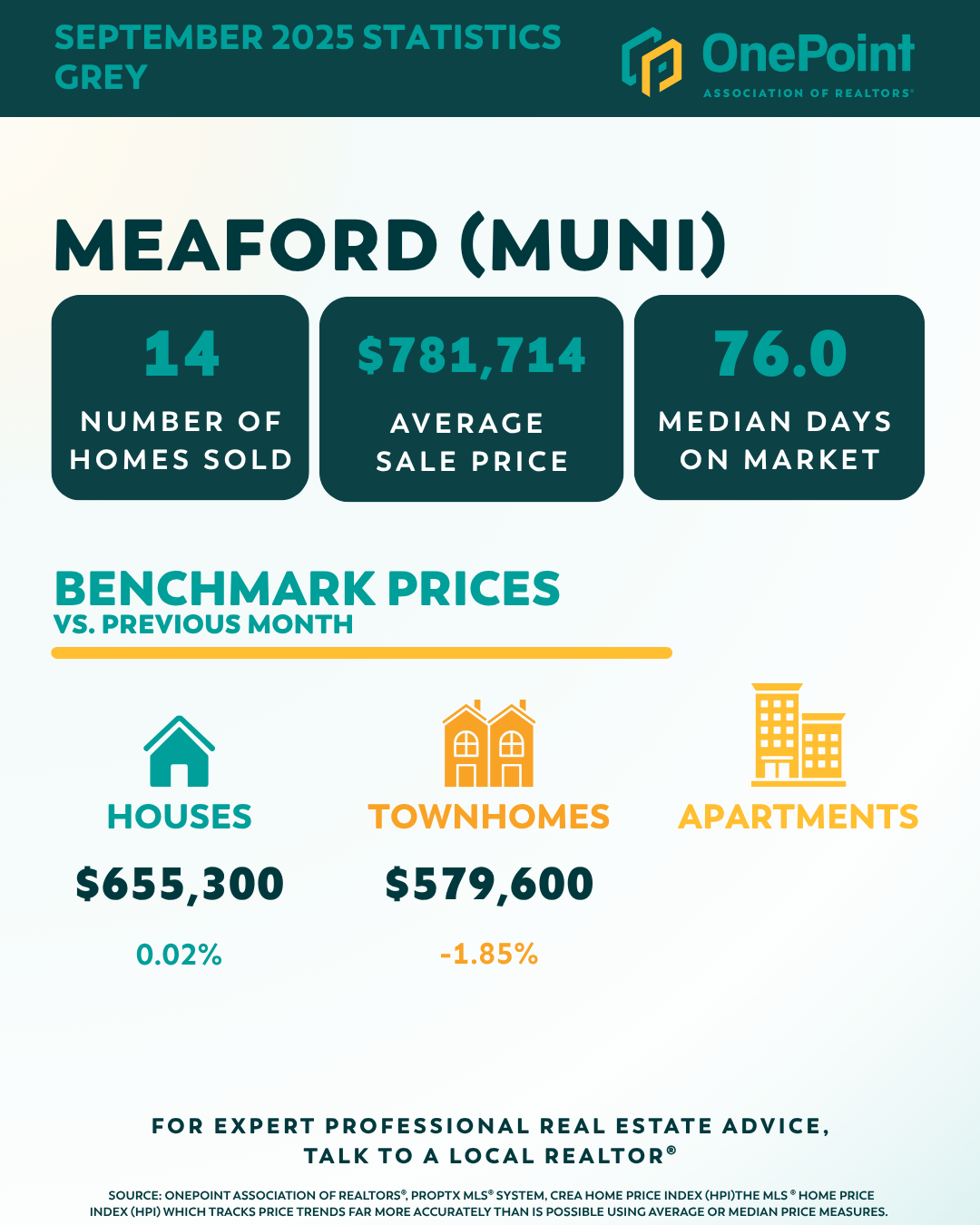

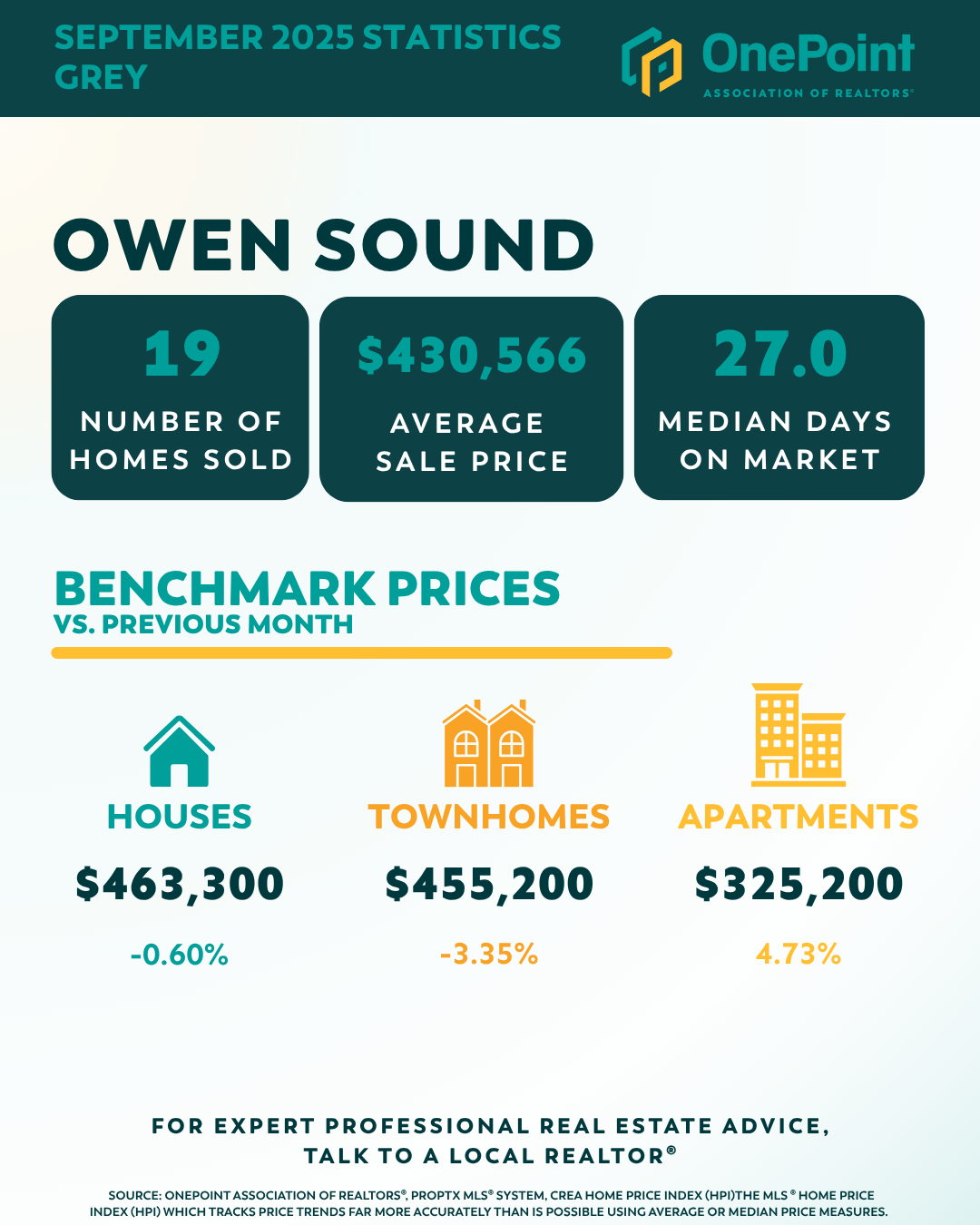

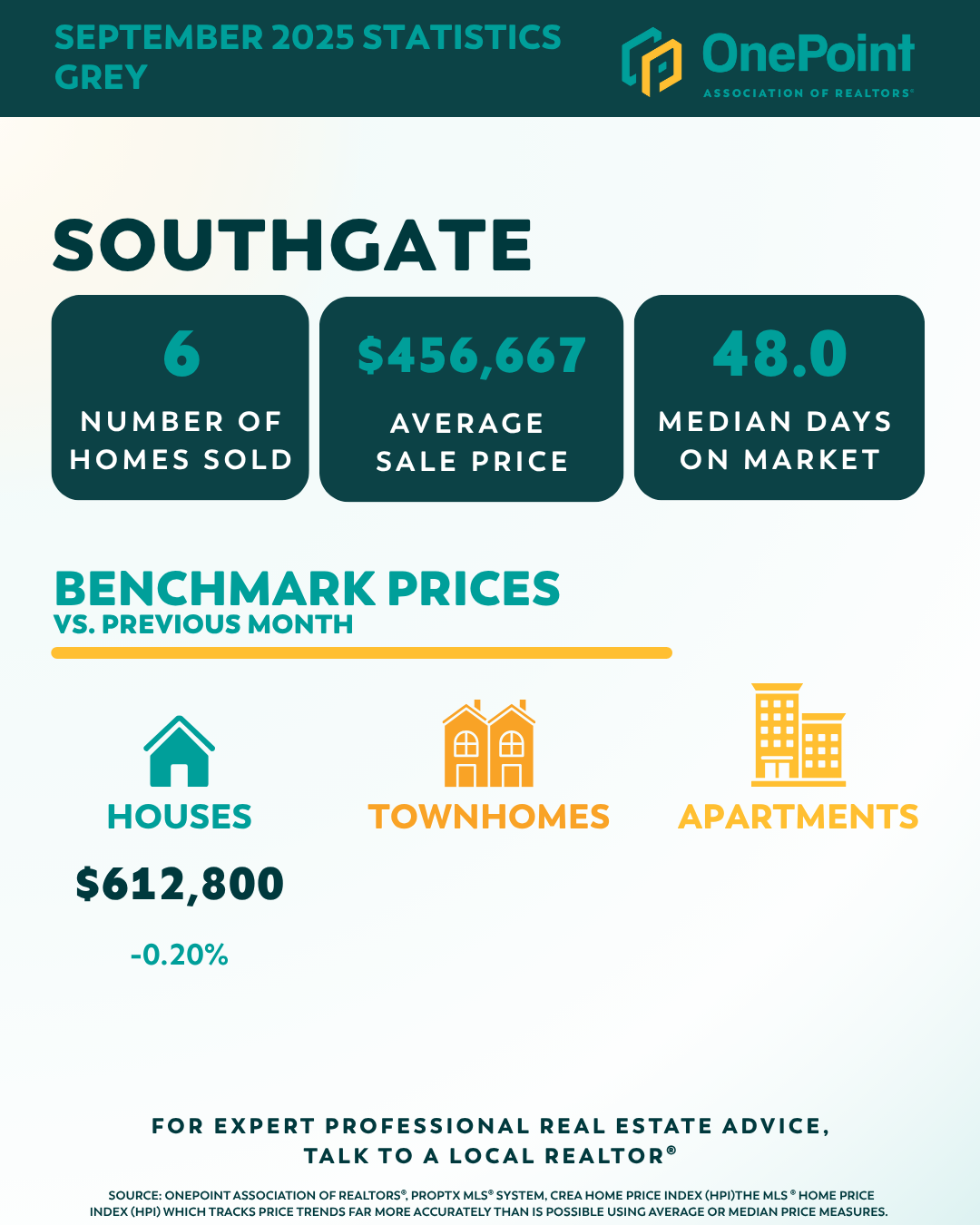

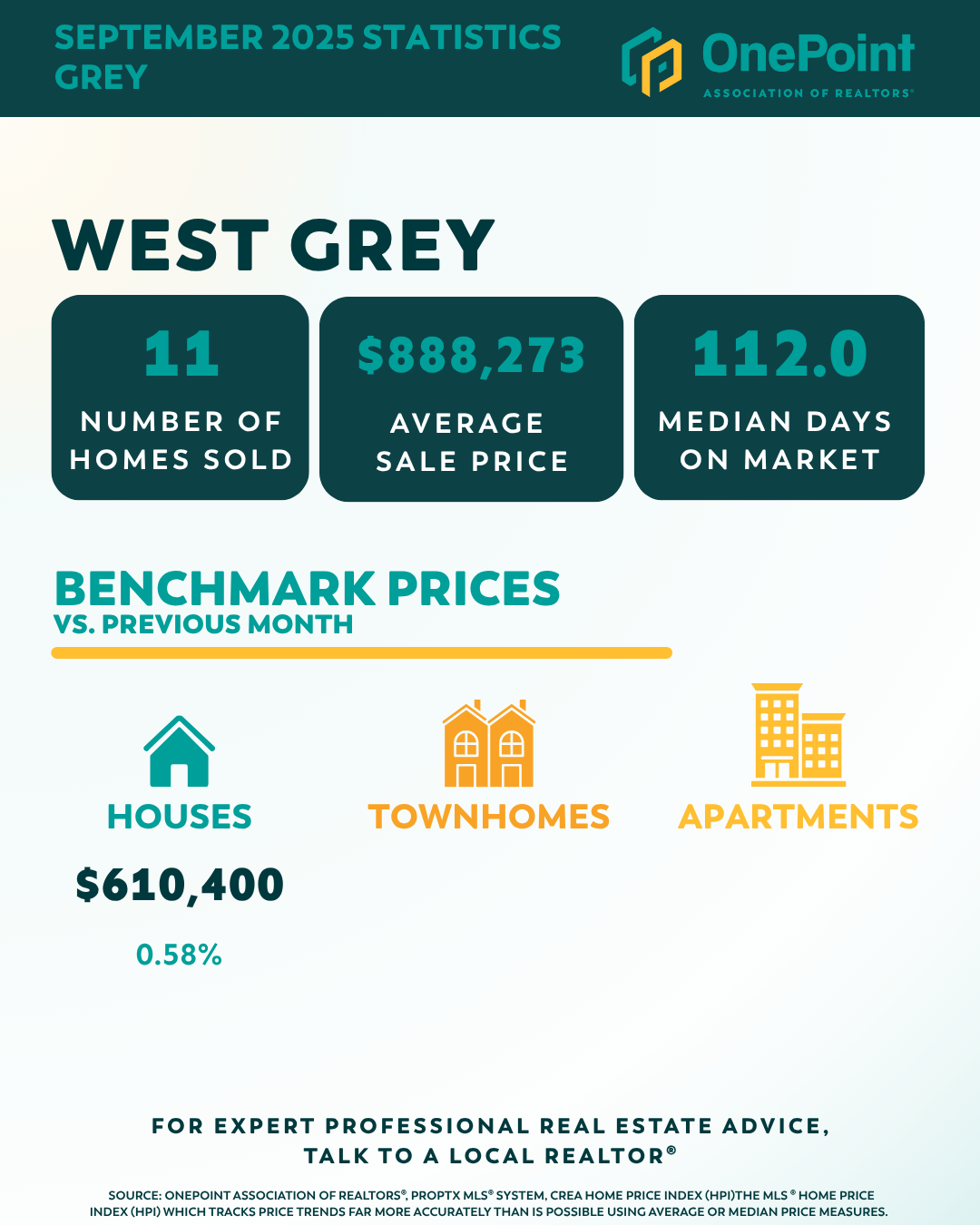

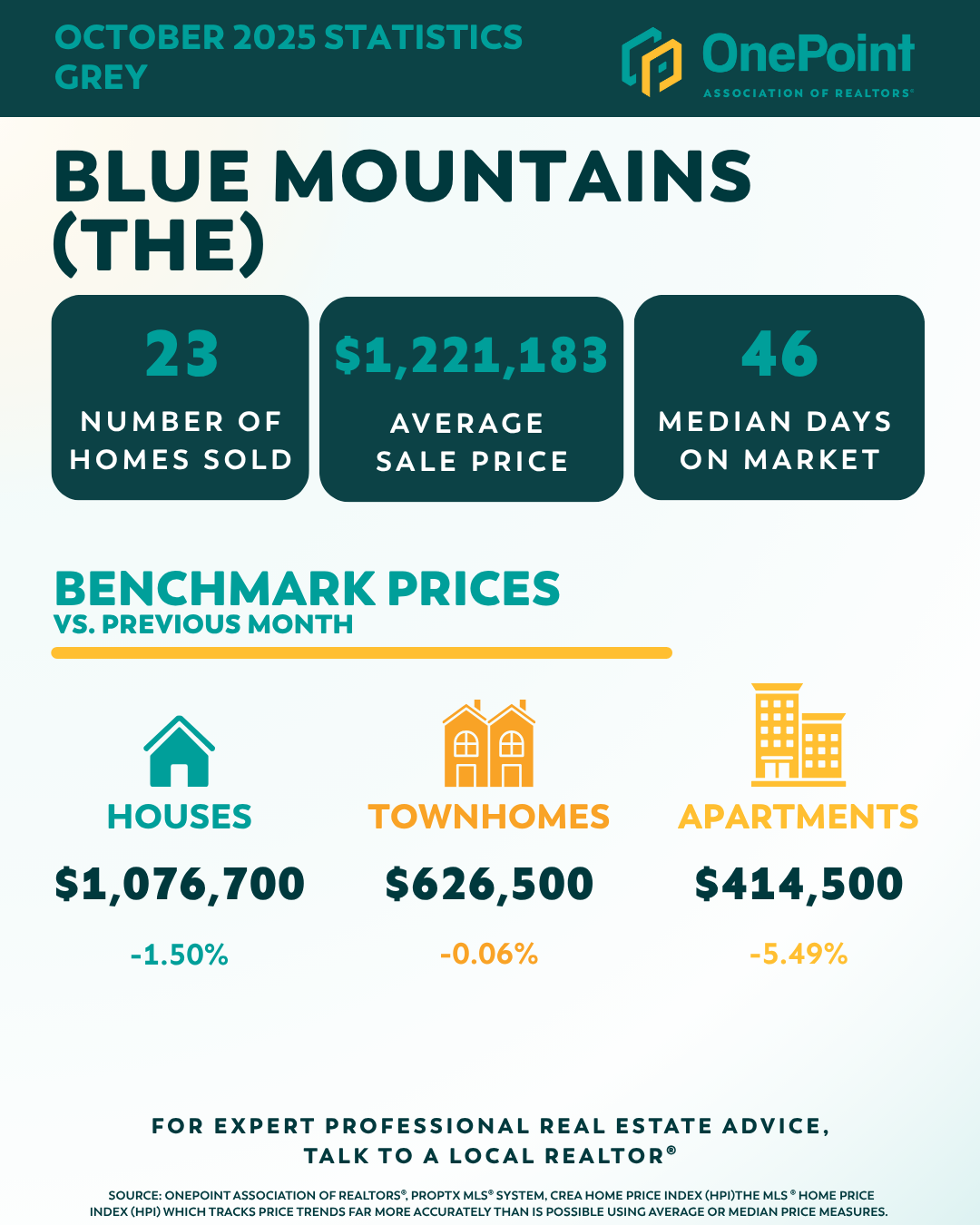

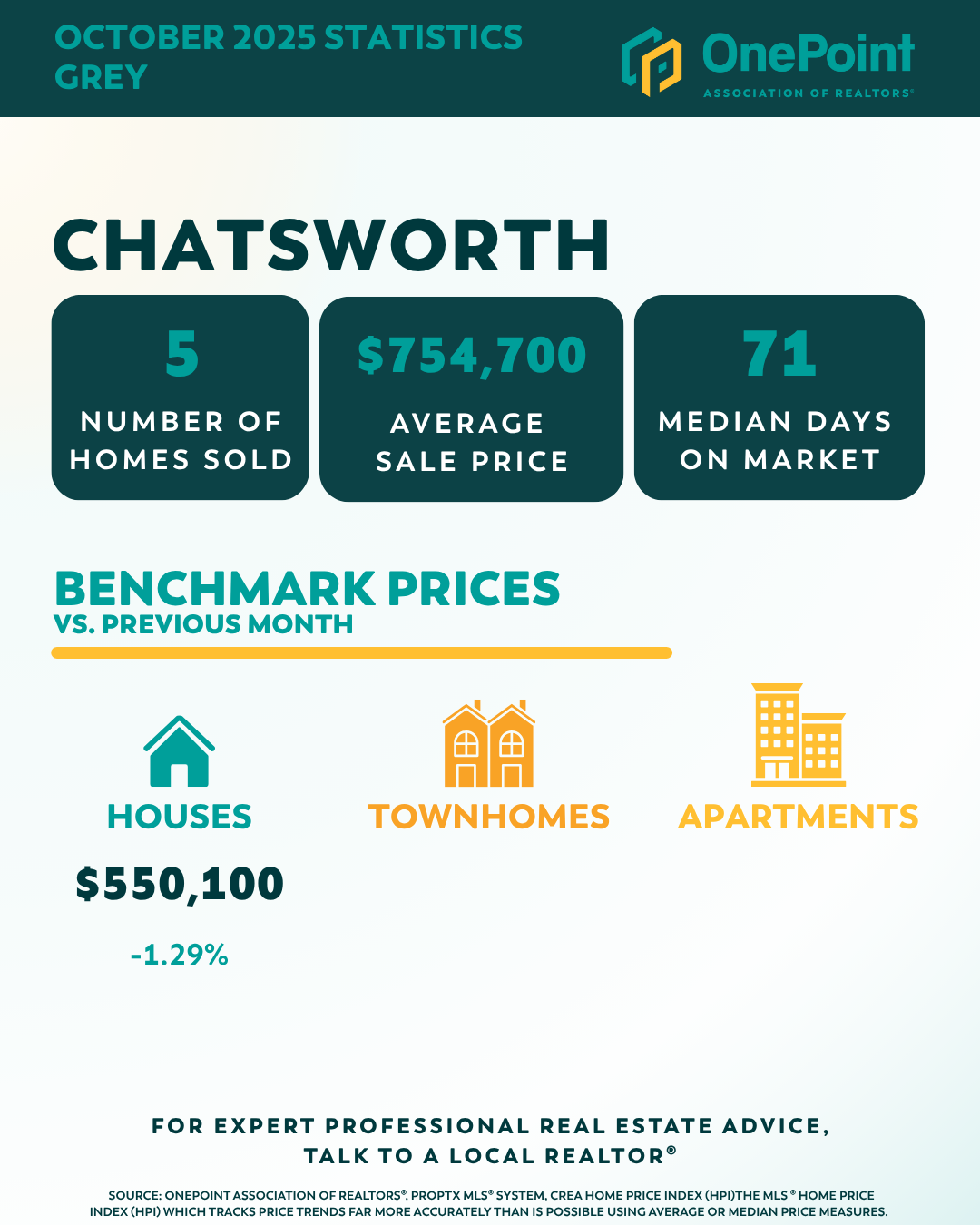

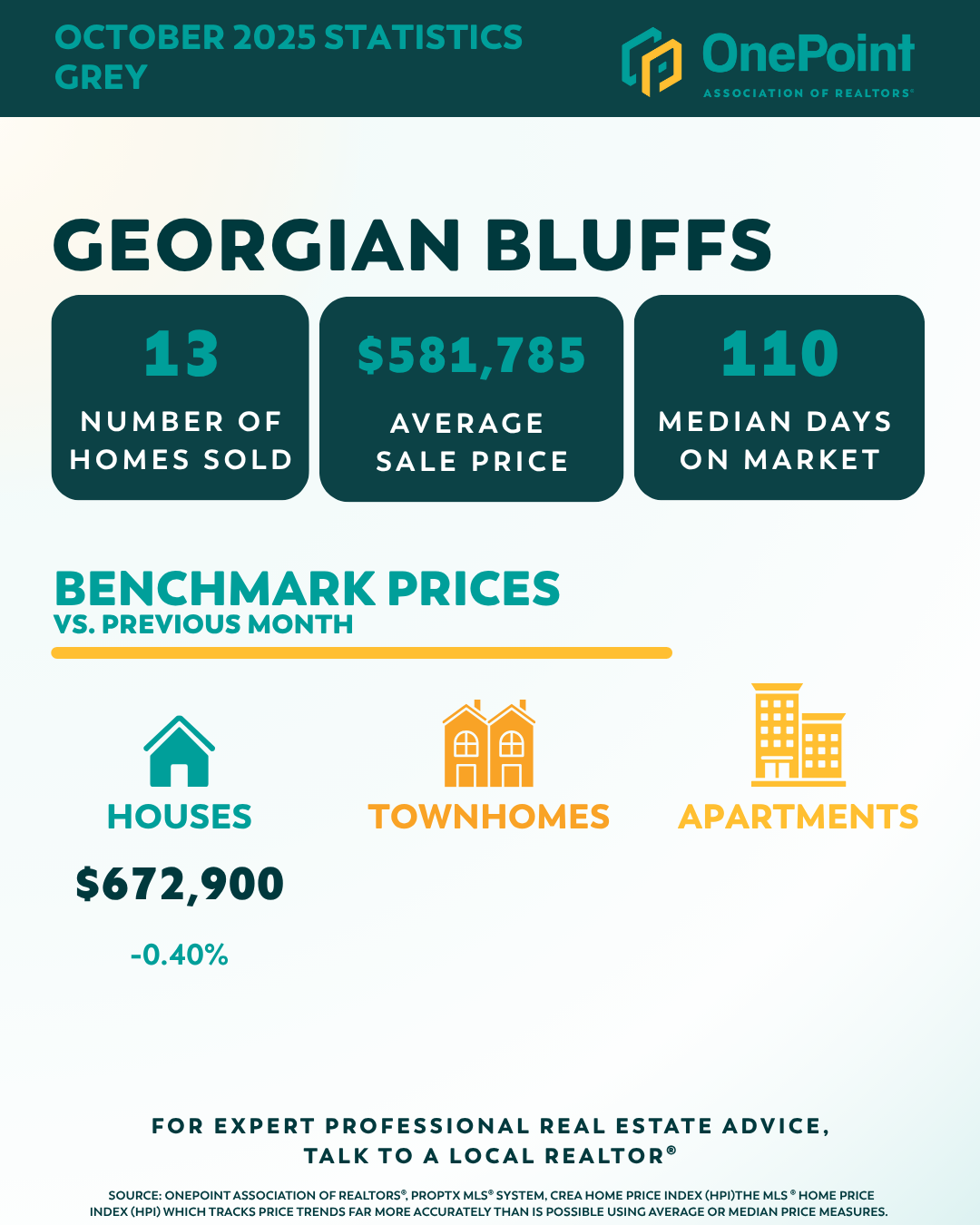

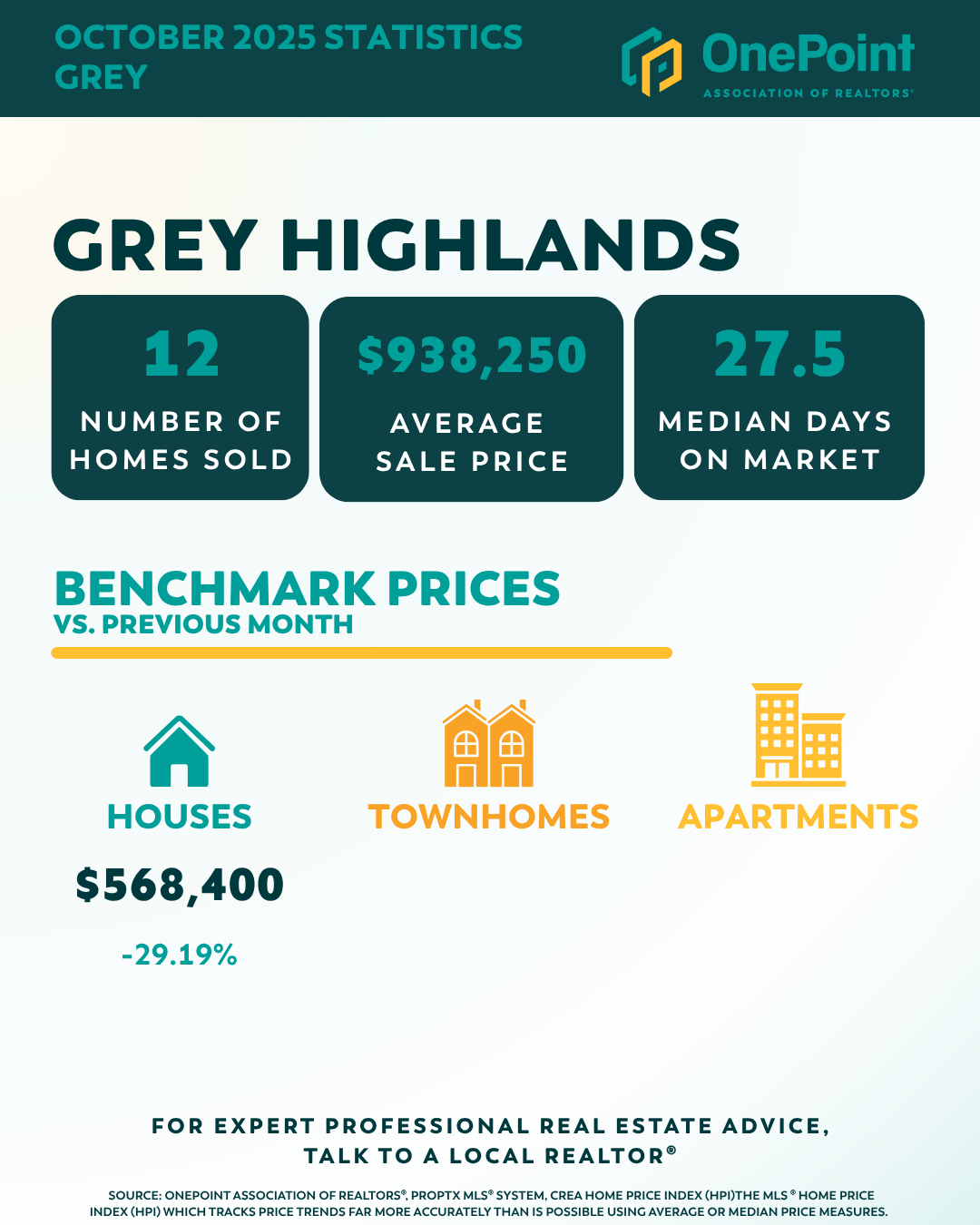

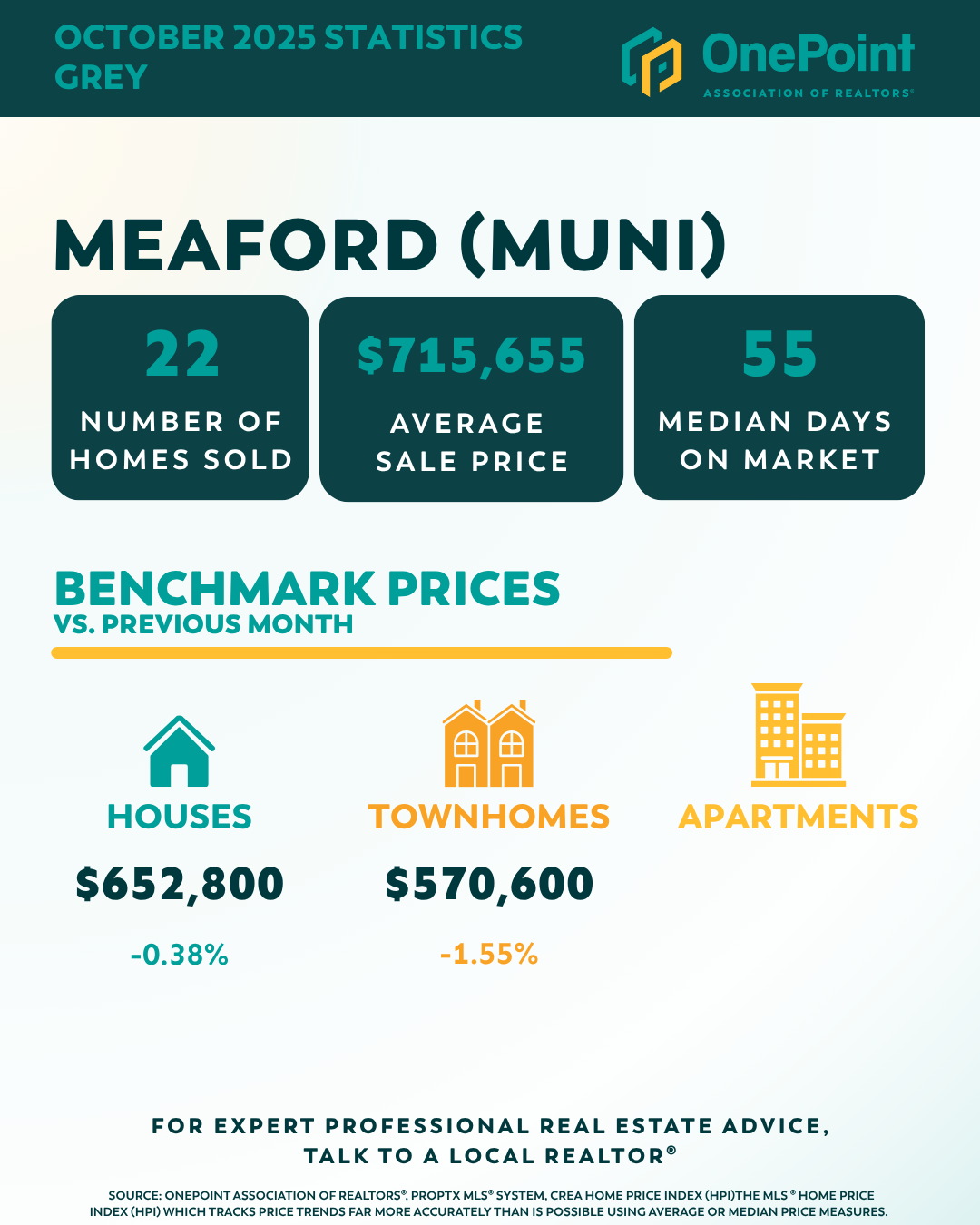

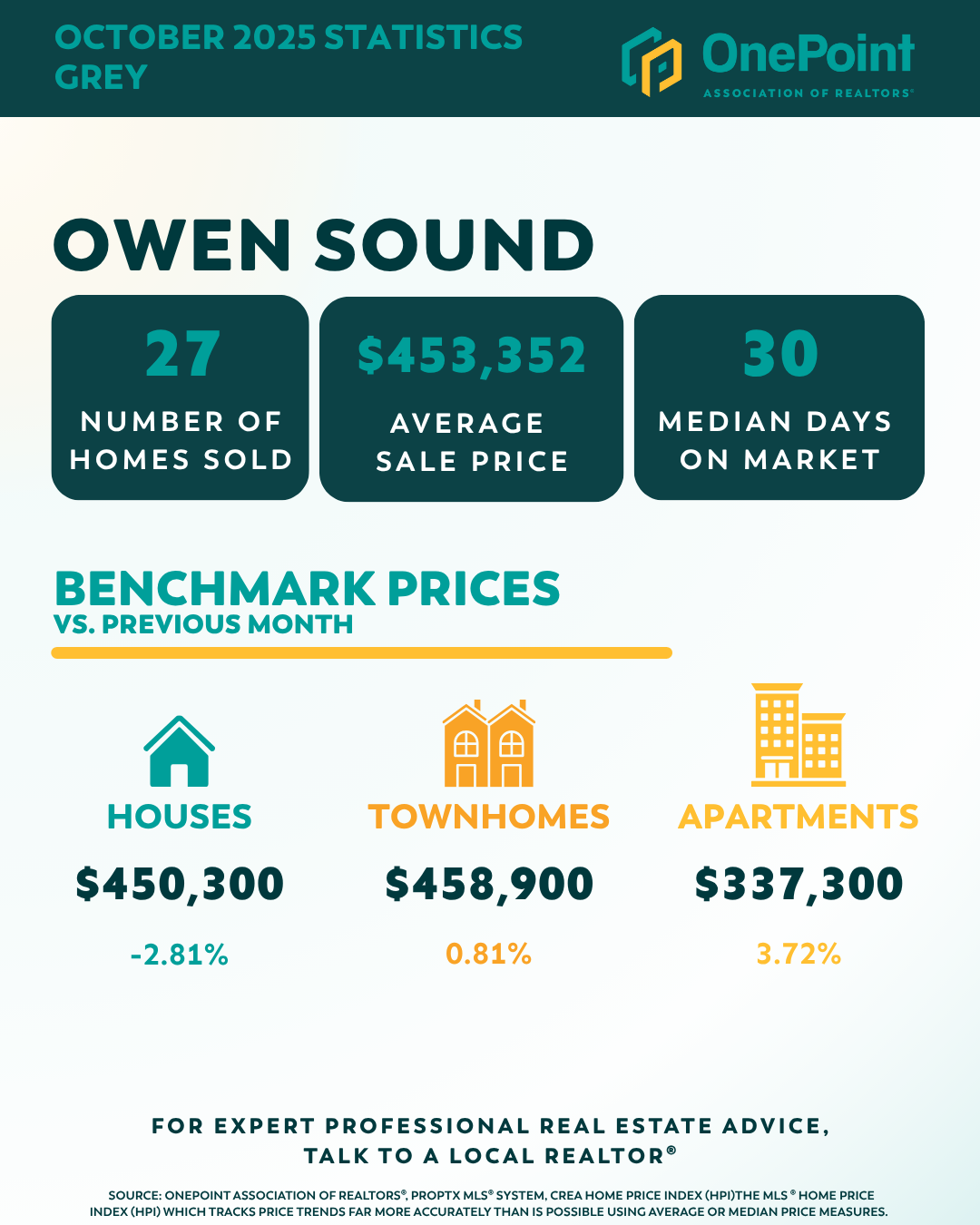

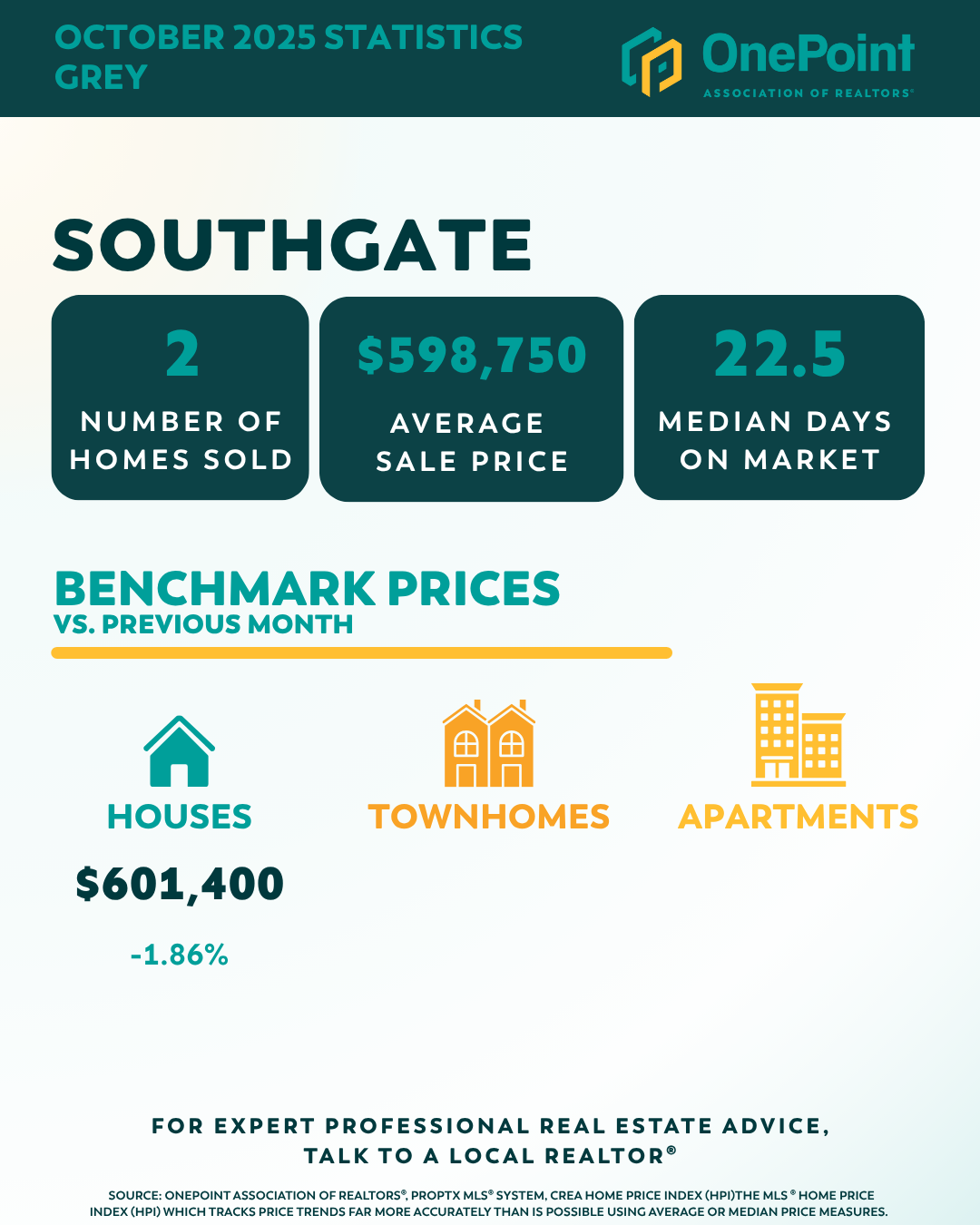

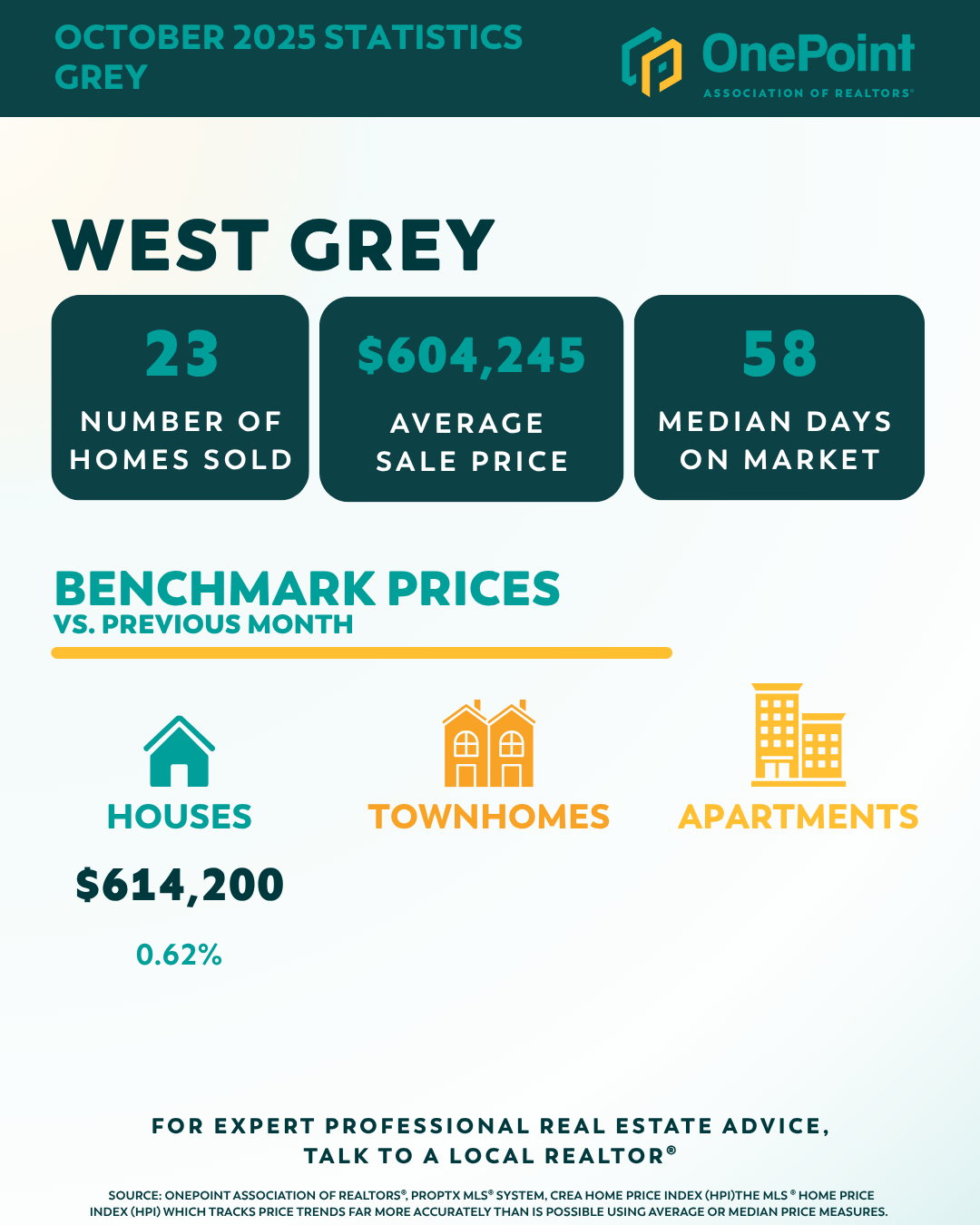

In this update, we’ll take a closer look at the October 2025 housing market stats for The Blue Mountains, Chatsworth, Georgian Bluffs, Grey Highlands, Hanover, Meaford, Owen Sound, Southgate, and West Grey. From home prices to sales activity, this snapshot will help you see how each community is performing in today’s market.

Thinking about your next move? Contact me for a free, no-obligation consultation, personalized advice for buyers and sellers, and complimentary property valuations. Let’s talk about your goals and make your real estate journey a success!

Grey County Housing Market Update for October 2025

Board & Association Information

OnePoint Association of REALTORS® serves as a unified body representing almost 3,000 real estate professionals across the regions of Huron, Perth, Grey, Bruce, Wellington, Georgian Bay, Simcoe, Parry Sound, Haliburton and Muskoka.

Wondering how these numbers might impact your real estate plans? Whether you’re buying, selling, or just curious about market trends, I’ve got you covered! Let’s navigate the market together! Contact me for a complimentary, no-obligation property valuation!

For more information, contact:

Susan Moffat, REALTOR® with Century 21 In-Studio Realty Inc., Brokerage

519.377.5154

susan.moffat@c21.ca

Bank of Canada Lowers Policy Rate to 2¼% | Oct 29, 2025

Oct 29, 2025: The Bank of Canada has just lowered its key interest rate to 2.25% today, aiming to support price stability and help the economy navigate challenging global trade conditions. This move may offer relief for borrowers and create new opportunities for home buyers.

Looking Ahead

The Bank of Canada’s next rate announcement is scheduled for Wednesday, December 10, 2025. The Bank’s next Monetary Policy Report (MPR) will be released on January 28, 2026.

Final Thoughts

For anyone considering a home purchase, refinancing, or business expansion, today’s rate cut could offer opportunities. However, as always, it’s important to get advice tailored to your financial situation before making big decisions.

Disclaimer: This blog is for informational purposes only and does not constitute financial or legal advice. Always consult with qualified professionals for guidance specific to your circumstances.

Read the Press Release.

Whether you’re a homeowner, prospective buyer, or real estate investor, understanding these market changes is crucial. As your trusted REALTOR®, I’m here to help you navigate these shifts and make informed decisions! Call, text, email, or DM me to chat about how this announcement affects your real estate plans!

For more information, contact:

Susan Moffat, REALTOR® with Century 21 In-Studio Realty Inc., Brokerage

519.377.5154

susan.moffat@c21.ca

5 Home Maintenance Tips Every New Homeowner Should Know

Buying a home is an exciting milestone but it also comes with a long list of responsibilities. Unlike renting, there’s no landlord to call when something breaks or routine upkeep is needed. Whether your home is brand new, recently renovated, or a charming older property, knowing how to stay on top of maintenance will protect your investment and keep daily life running smoothly. Here are five home maintenance tips every new homeowner should have on their checklist:

Learn the Basics of Your Home’s Systems

As soon as you move in, get to know how your home functions — from the electrical panel to the main water shut-off valve. If an emergency happens, like a burst pipe or power outage, knowing these locations can save you stress and costly damage. This knowledge will make you feel more confident when handling unexpected issues.

- Label circuit breakers clearly.

- Test smoke and carbon monoxide detectors.

- Learn how to reset your furnace, water heater, or breaker box.

Prioritize Seasonal Maintenance

Every season brings its own to-do list, but tackling small tasks regularly prevents bigger (and more expensive) problems later. Make a calendar to remind yourself of key chores, or hire professionals when necessary. For example:

- Spring: Clean gutters, check for winter roof damage, and service your HVAC system.

- Summer: Inspect outdoor decks, siding, and windows; trim trees away from the home.

- Fall: Rake leaves, winterize outdoor faucets, and schedule a furnace tune-up.

- Winter: Watch for ice dams and keep pathways clear of snow to prevent slips.

Build a Basic Tool Kit

You don’t need a full workshop, but a few essential tools will help you handle minor repairs confidently. A hammer, screwdriver set, wrench, pliers, measuring tape, stud finder, and power drill should cover most small projects. As you grow more comfortable, you can add to your collection. Having the right tools on hand makes it easier to stay proactive instead of putting off repairs.

Keep Up with Small Repairs

A squeaky hinge, leaky faucet, or loose railing might feel minor, but delaying small fixes can lead to bigger problems down the road. Regularly walk through your home and take note of things that need attention. Whether it’s patching a bit of drywall or replacing a worn weatherstrip, small repairs not only protect your home but also improve comfort and energy efficiency.

Track Your Home’s Maintenance and Upgrades

Keep a dedicated binder or digital folder to store receipts, warranties, and service records, along with notes on when maintenance was last completed. This makes it easier to budget for future expenses, schedule routine services, and prove care if you ever sell your home.

Final Thoughts

Owning a home is all about consistency. The more proactive you are with maintenance, the fewer surprises you’ll face later. Start small, build good habits, and remember: caring for your home protects both your investment and your peace of mind.

Looking to buy, sell, or invest? As your REALTOR®, I’ll guide you every step of the way. Contact me today to schedule a free consultation and let’s turn your real estate dreams into reality!

For more information, contact:

Susan Moffat, REALTOR® with Century 21 In-Studio Realty Inc., Brokerage

519.377.5154

susan.moffat@c21.ca

Creating the Perfect Laundry Room

A laundry room – if you are fortunate enough to have a dedicated one – is one of the most underrated yet important spaces in any home. While it may not be the first thing guests see, or the ultimate deal-breaker for buyers down the road, most homeowners spend hours each week in this space. That’s why it deserves thoughtful design that is not only functional but also pleasant to use.

If you’re looking to refresh or design your laundry room, here are some practical tips to keep in mind:

Focus on Appliance Placement

The washer and dryer are the heart of the laundry room, so plan your layout around them. Consider whether stacking them vertically makes sense for saving floor space, or if placing them side-by-side allows you to gain a counter surface above. For tighter spaces, there are compact, condo-sized machines that fit neatly into closets and still get the job done.

Maximize Storage & Organization

Laundry rooms often double as a utility closet, so smart storage is essential. Install cabinets or open shelving to keep detergents, linens, and cleaning supplies neatly tucked away. For tall items like brooms or ironing boards, hooks behind the door can be a simple solution. And don’t forget a designated spot for hampers, baskets, and buckets—think under-shelf storage or rolling bins.

Add a Functional Work Surface

Folding, sorting, and prepping clothes is much easier with counter space. Even in compact rooms, installing a countertop over side-by-side laundry machines can help. If you do a lot of air drying, consider adding a wall-mounted drying rack or a clothing rod for hangers.

Consider a Deep Utility Sink

Whether pre-soaking clothes, rinsing out mop buckets, or tackling messy household tasks, a deep sink is a major convenience. Pair it with cabinets underneath for extra storage of items like an iron, steamer, or cleaning products.

Optimize Your Floor Plan with Doors

In smaller laundry rooms, a traditional swinging door can eat up valuable space. Swapping it for a pocket door (or even a sliding barn door for style) can improve flow and make the room feel more open.

Choose Durable, Easy-to-Clean Finishes

This is a hardworking space, so your materials should be too. Non-porous countertops like quartz resist stains and heat. Melamine cabinet finishes are durable and budget-friendly. For floors, ceramic or porcelain tile offer excellent durability, while vinyl provides a more budget-conscious, water-resistant option.

Brighten the Room

Laundry rooms don’t always have natural light, so good lighting is essential. Bright task lighting overhead makes the space more functional, and painting walls in light, cheerful tones (like crisp white, soft blues, or even sunny yellow) can make the room feel bigger and more inviting.

Final Thoughts on Creating the Perfect Laundry Room

A well-designed laundry room may not be the first thing people think of when buying a home, but it’s a space that homeowners truly appreciate once they live there. Making this space functional, organized, and visually uplifting can add comfort and everyday value to your home—something that future buyers will definitely notice.

If you’re considering home improvements before selling or simply want to enjoy your home more, don’t overlook the laundry room. A few thoughtful upgrades can make this hardworking space a standout feature.

Looking to buy, sell, or invest? As your REALTOR®, I’ll guide you every step of the way. Contact me today to schedule a free consultation and let’s turn your real estate dreams into reality!

For more information, contact:

Susan Moffat, REALTOR® with Century 21 In-Studio Realty Inc., Brokerage

519.377.5154

susan.moffat@c21.ca

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link