Creating a Kid’s Room They’ll Love to Spend Time In

As a real estate agent, you know that a well-designed kid’s room can be a major selling point for families looking for their next home. But even beyond real estate, parents are always searching for ways to create inviting, functional, and fun spaces for their children. Here’s how you can to design a kid’s room that’s both practical and magical.

Start with Safety and Comfort

Before diving into decor, ensure the room is safe and comfortable. This means:

- Childproofing: Secure furniture to the wall, cover electrical outlets, and choose non-toxic materials.

- Soft Lighting: Use gentle, adjustable lighting to create a cozy atmosphere.

- Comfortable Bedding: Invest in quality mattresses and soft, washable bedding.

Personalize with Their Interests

Kids love spaces that reflect their personalities and interests. Involve them in the design process:

- Favourite Colours and Themes: Let them pick a colour palette or theme—whether it’s dinosaurs, space, unicorns, or superheroes.

- Wall Art and Decals: Use removable wall decals or framed artwork that can grow with them.

- Personal Touches: Display their artwork or favourite books on open shelves.

Maximize Space and Functionality

Small bedrooms can still be big on fun. Smart storage and flexible layouts make all the difference:

- Multifunctional Furniture: Consider loft beds with desks underneath, or beds with built-in drawers.

- Organized Storage: Use bins, baskets, and labeled containers to keep toys and clothes tidy.

- Flexible Zones: Create separate areas for sleeping, playing, and studying.

Encourage Creativity and Play

A kid’s room should inspire imagination and play:

- Reading Nook: Add a cozy corner with pillows, blankets, and a small bookshelf.

- Art Station: Set up a table with supplies for drawing, crafting, or building.

- Interactive Elements: Chalkboard or whiteboard walls encourage creativity and can be easily updated.

Make It Easy to Update

Kids’ tastes change quickly. Design a room that’s easy to refresh:

- Neutral Base: Use neutral walls and furniture so accessories and decor can be swapped out.

- Modular Decor: Choose items that can be rearranged or replaced as interests evolve.

- DIY Projects: Encourage families to personalize the space with simple, reversible DIY projects.

Final Thoughts

A thoughtfully designed kid’s room not only makes everyday life more enjoyable for children but can also be a standout feature in a real estate listing. By focusing on safety, personalization, functionality, and flexibility, you can create a space that kids truly love to spend time in.

If you’re looking to buy or sell a home with family-friendly features, reach out—I’m here to help you find the perfect space for your family’s needs.

Looking to buy, sell, or invest? As your REALTOR®, I’ll guide you every step of the way. Contact me today to schedule a free consultation and let’s turn your real estate dreams into reality!

For more information, contact:

Susan Moffat, REALTOR® with Century 21 In-Studio Realty Inc., Brokerage

519.377.5154

susan.moffat@c21.ca

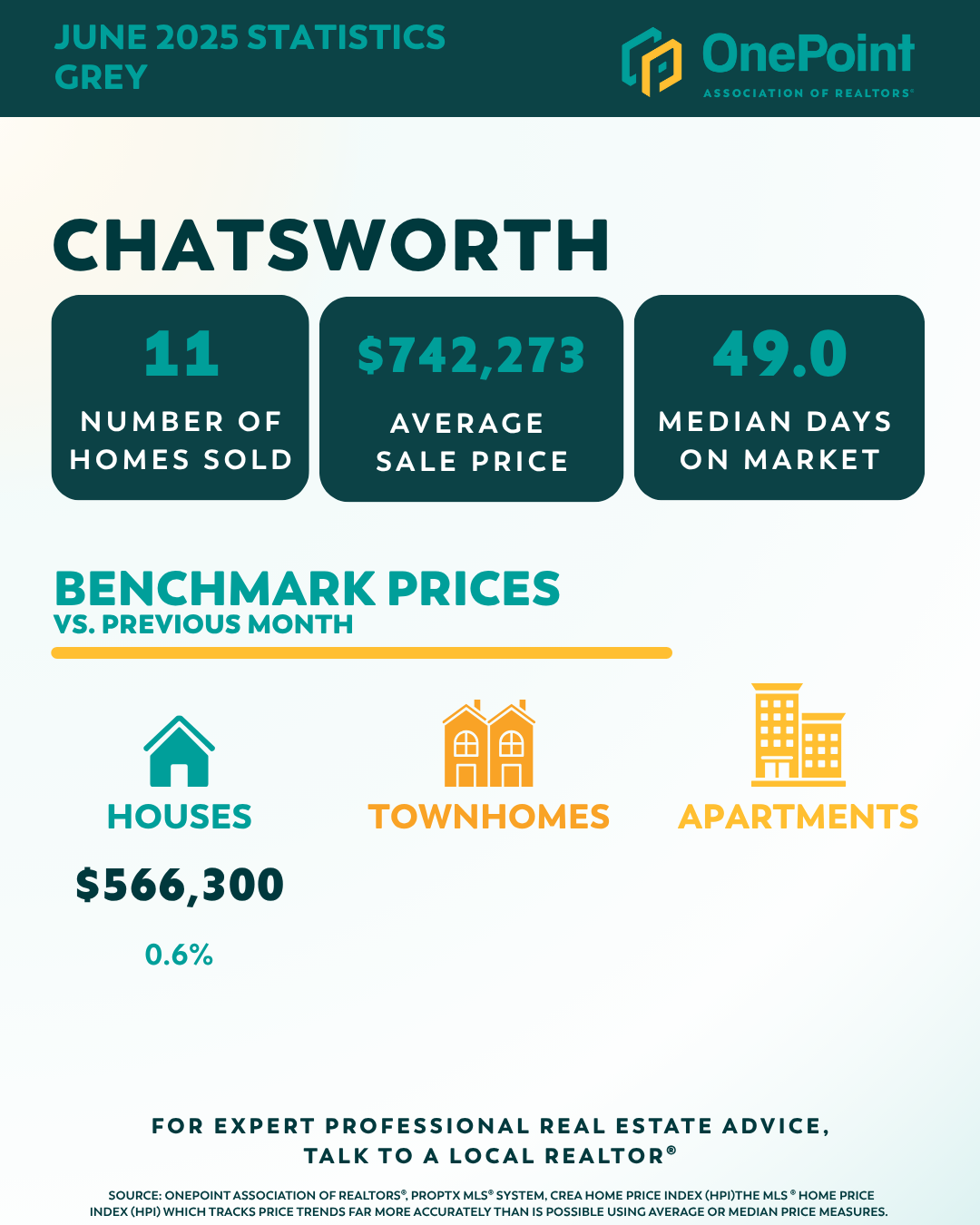

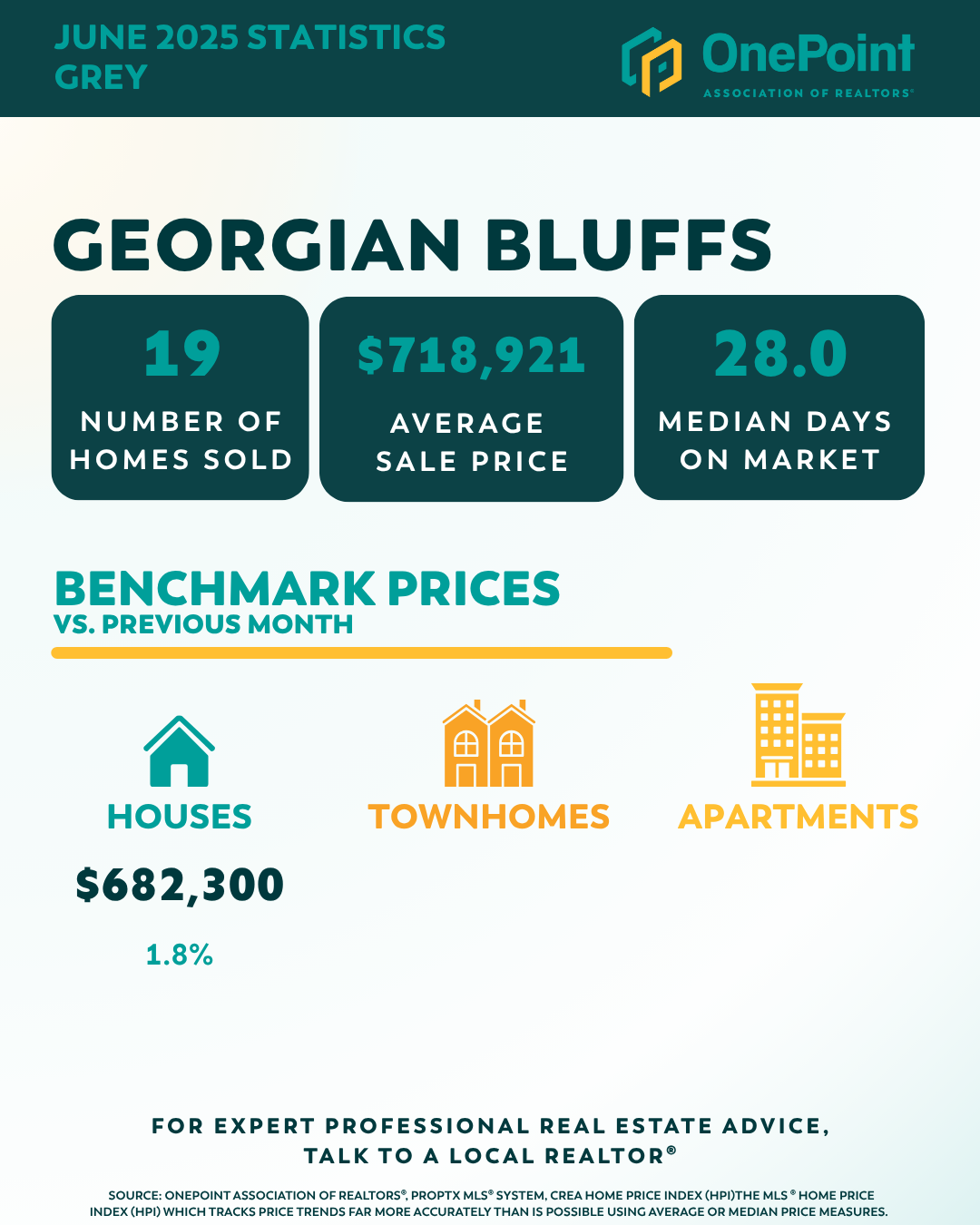

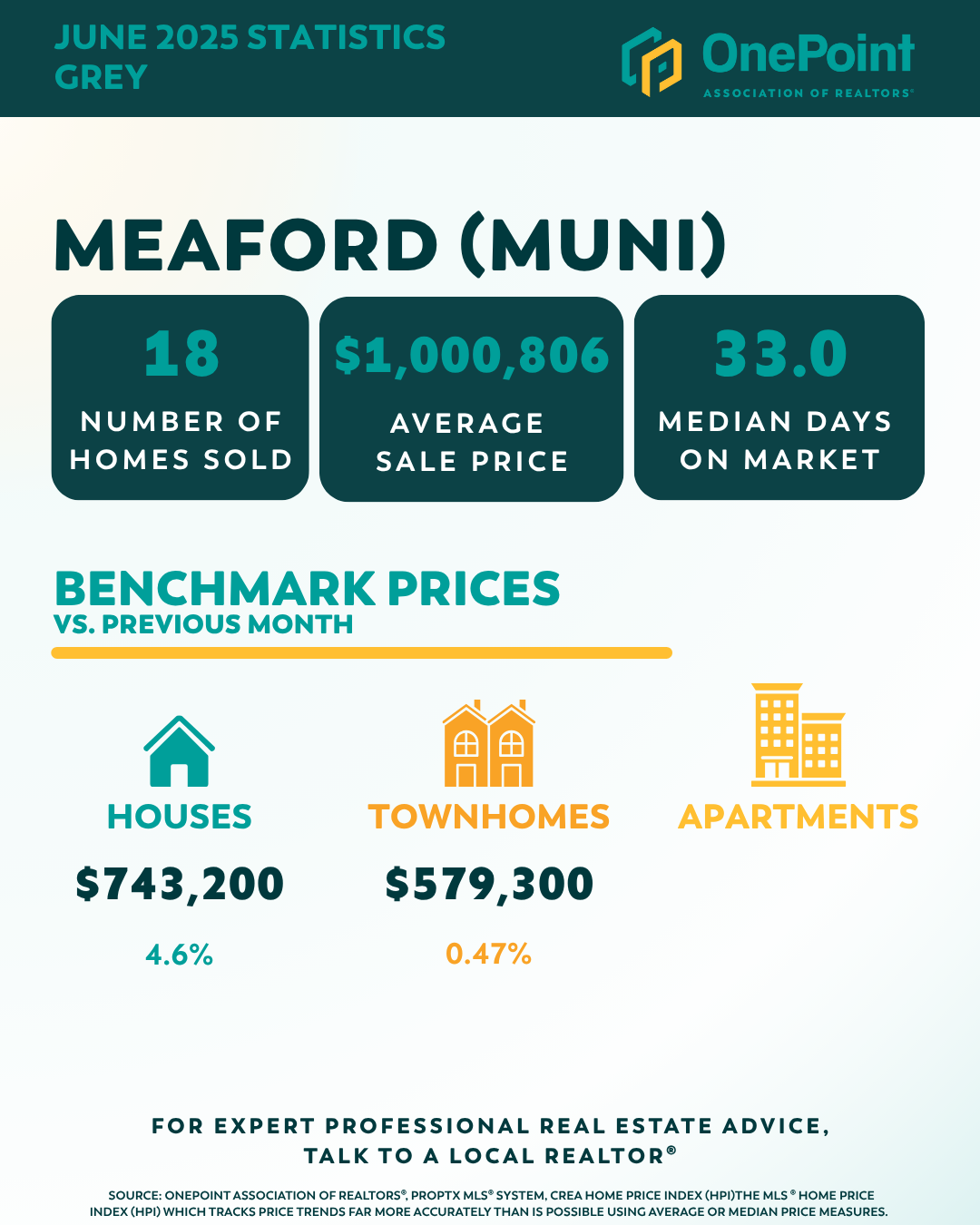

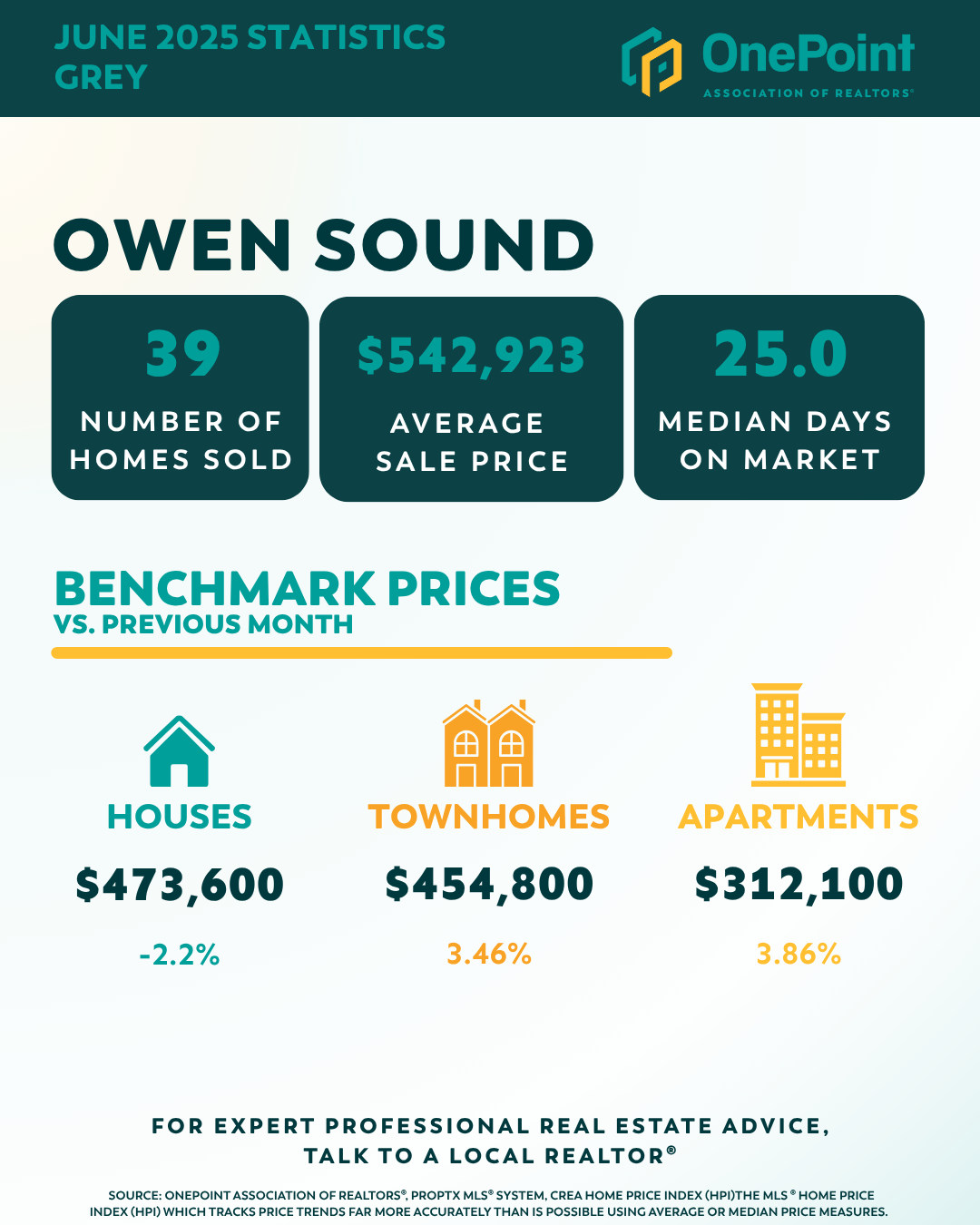

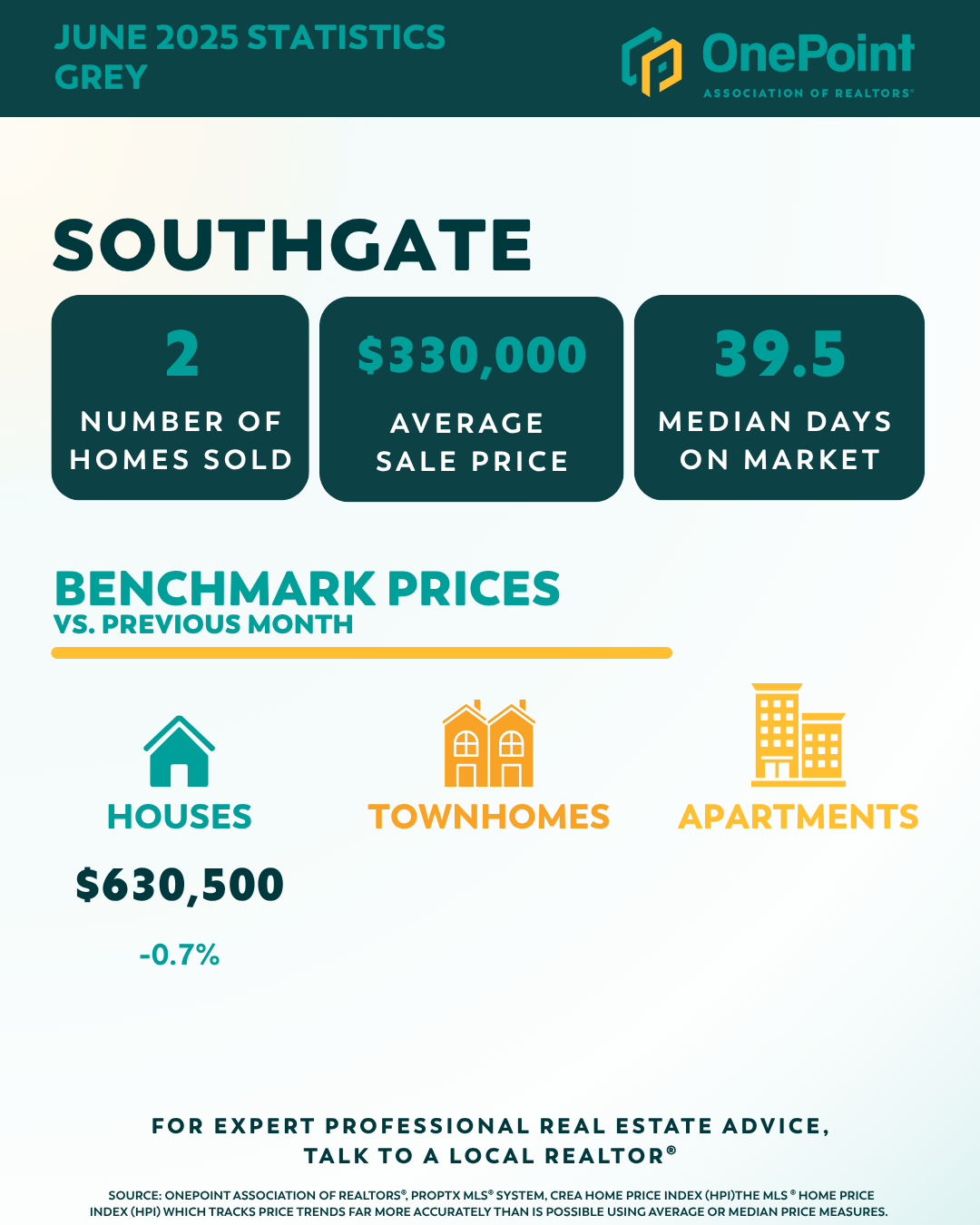

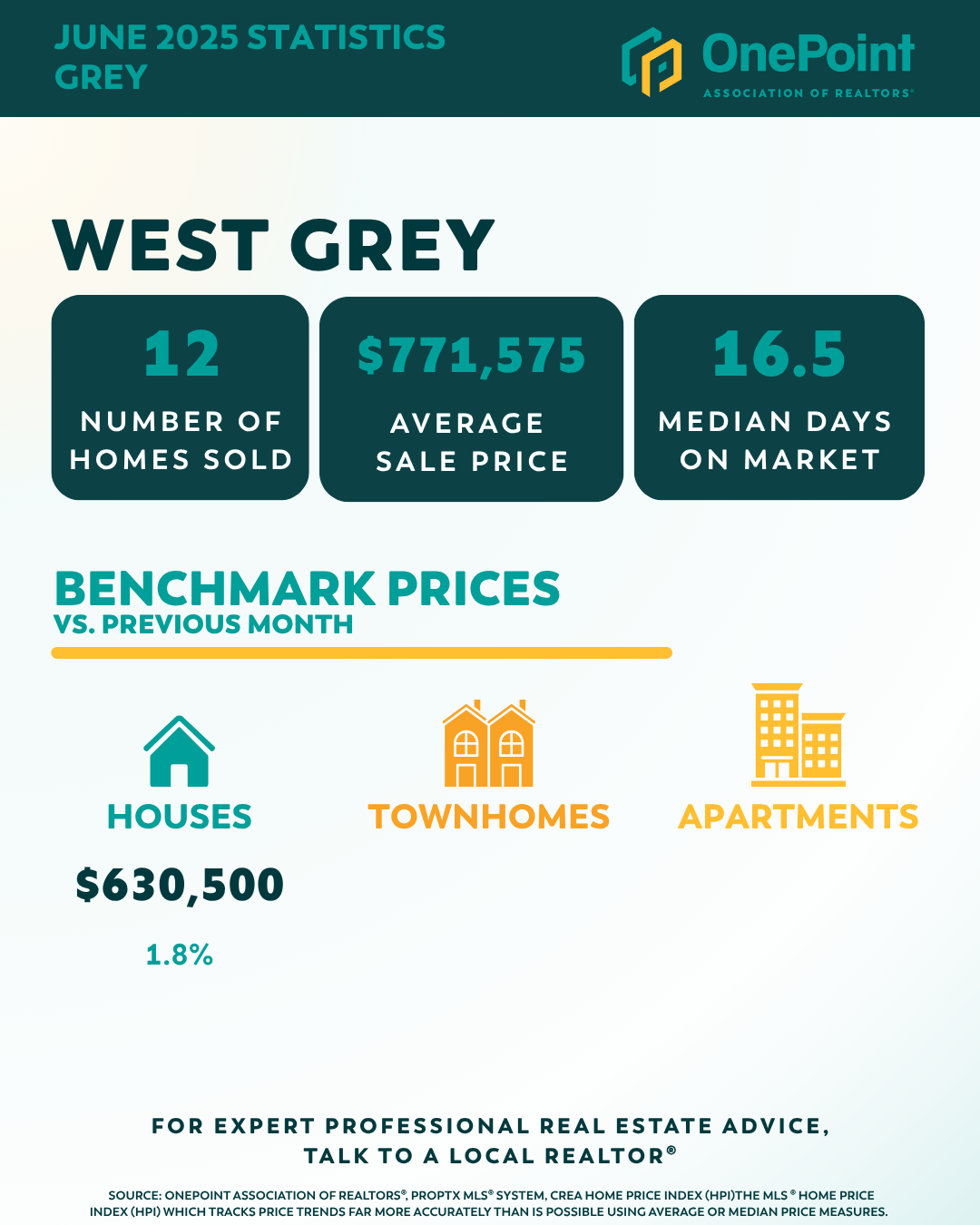

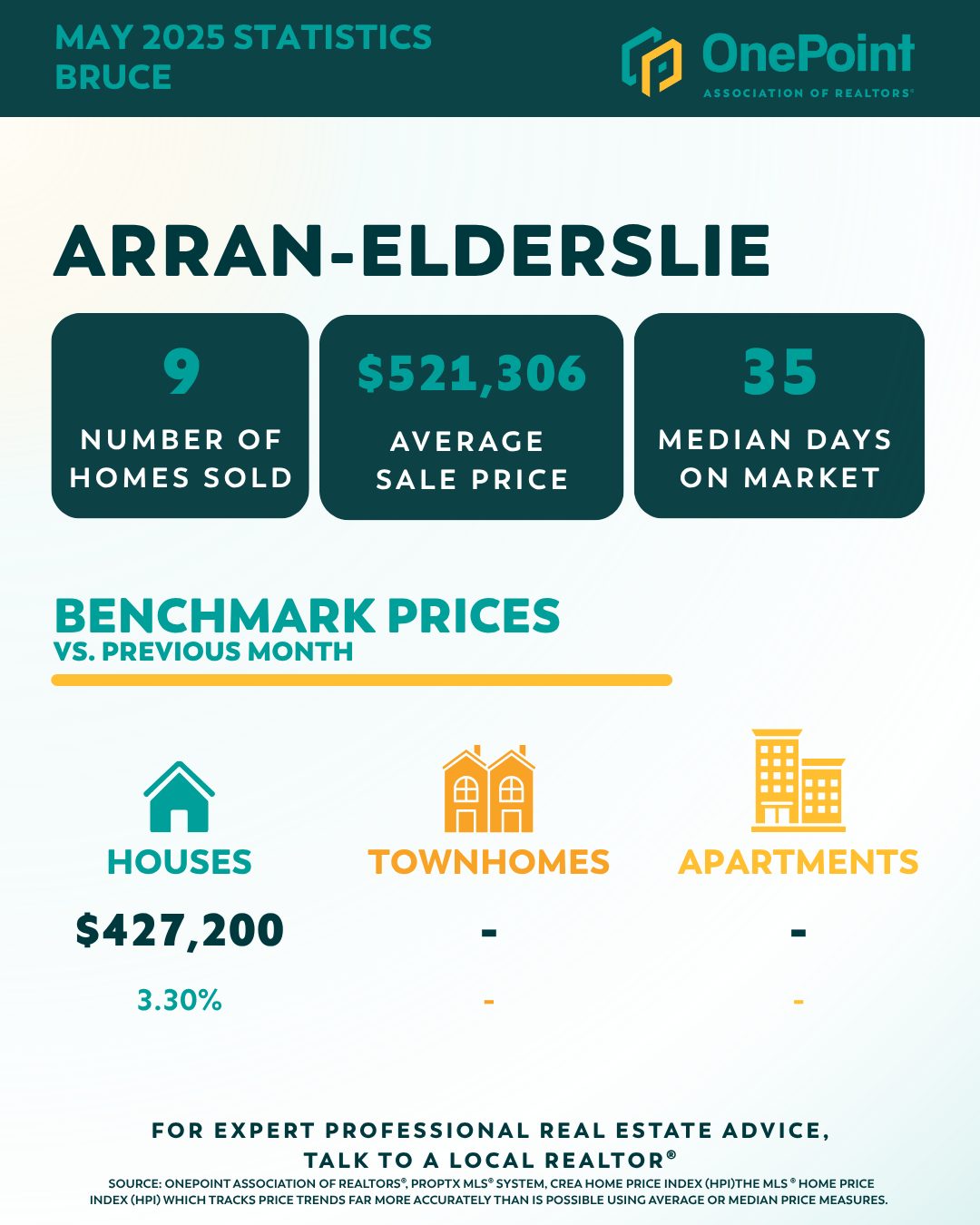

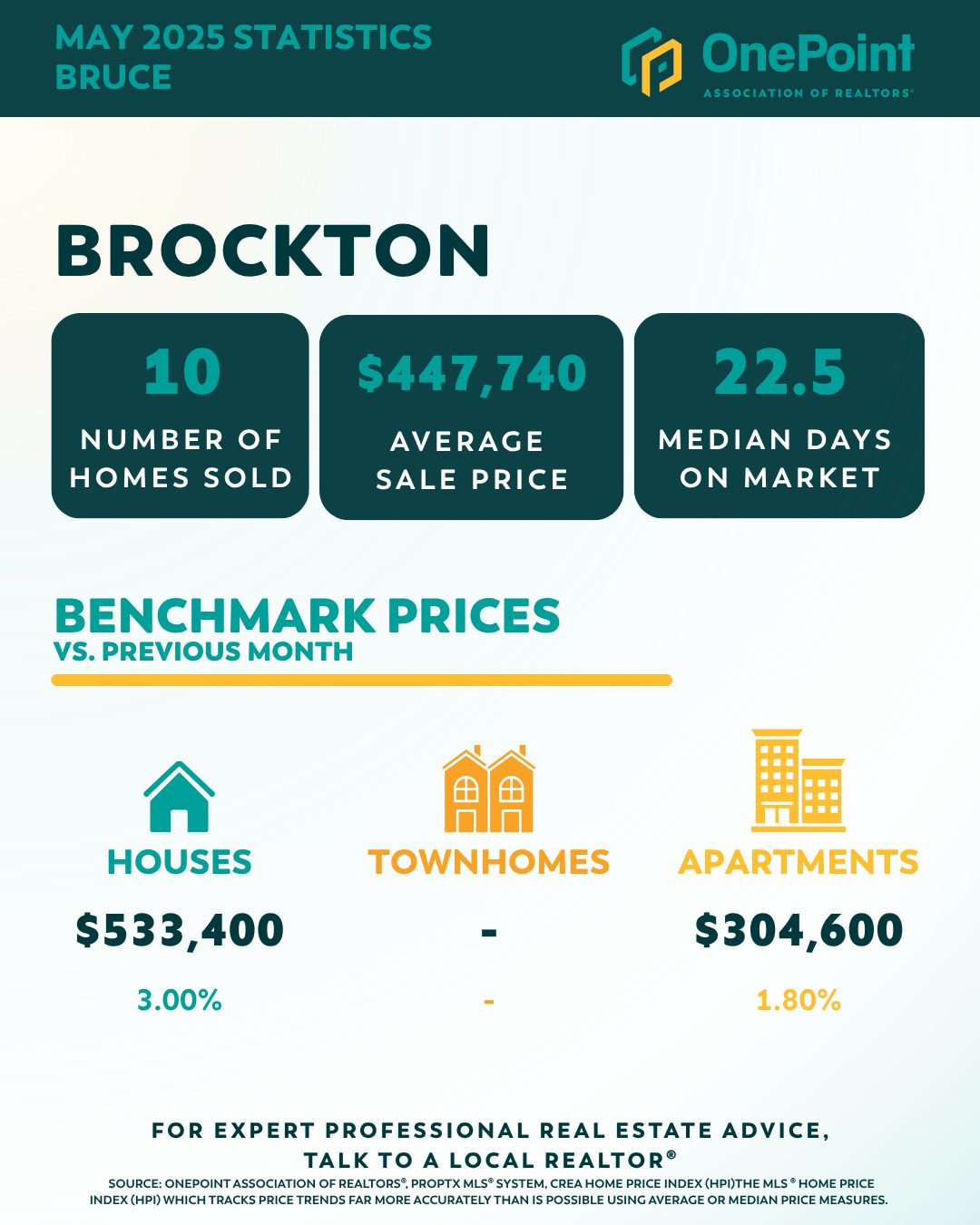

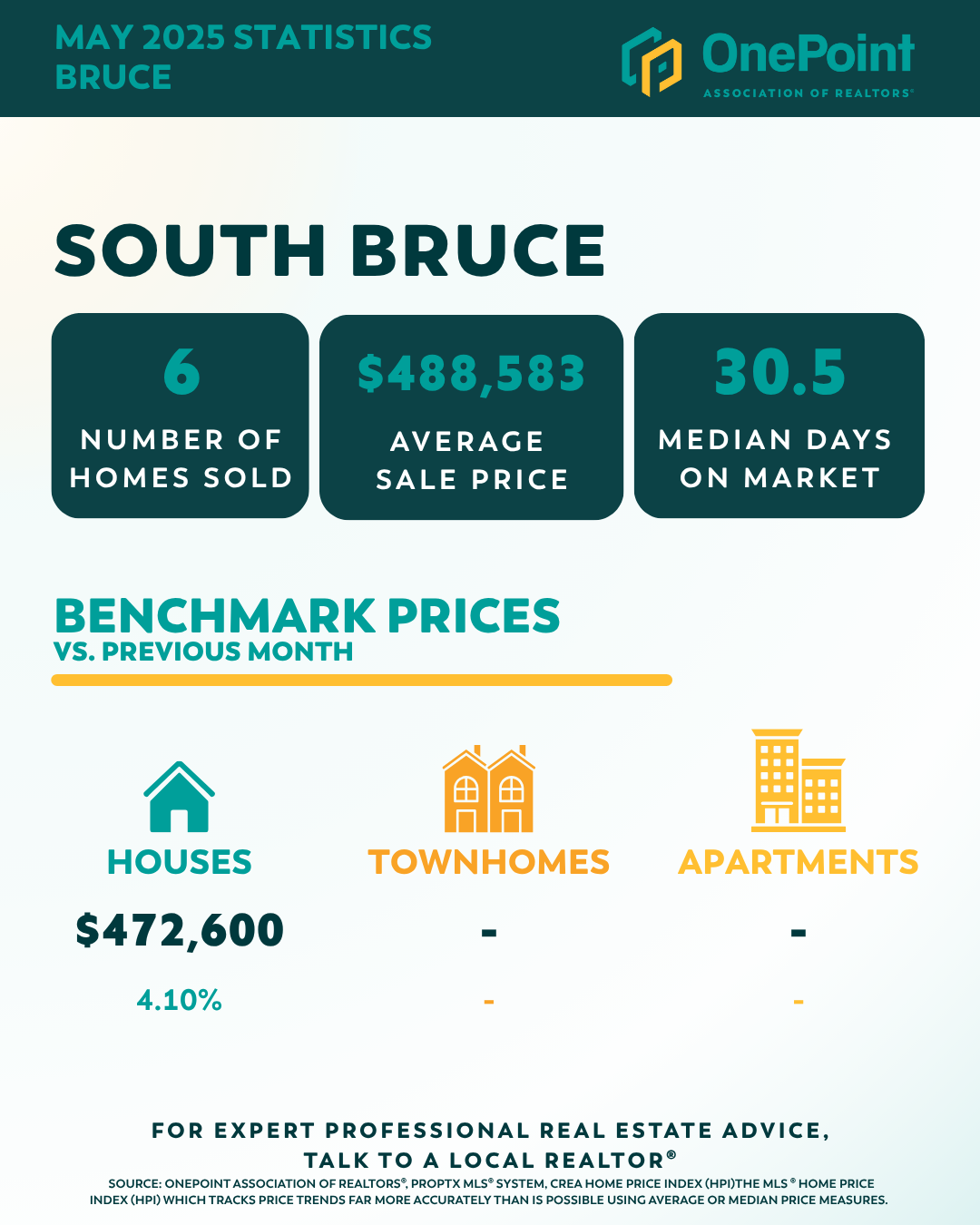

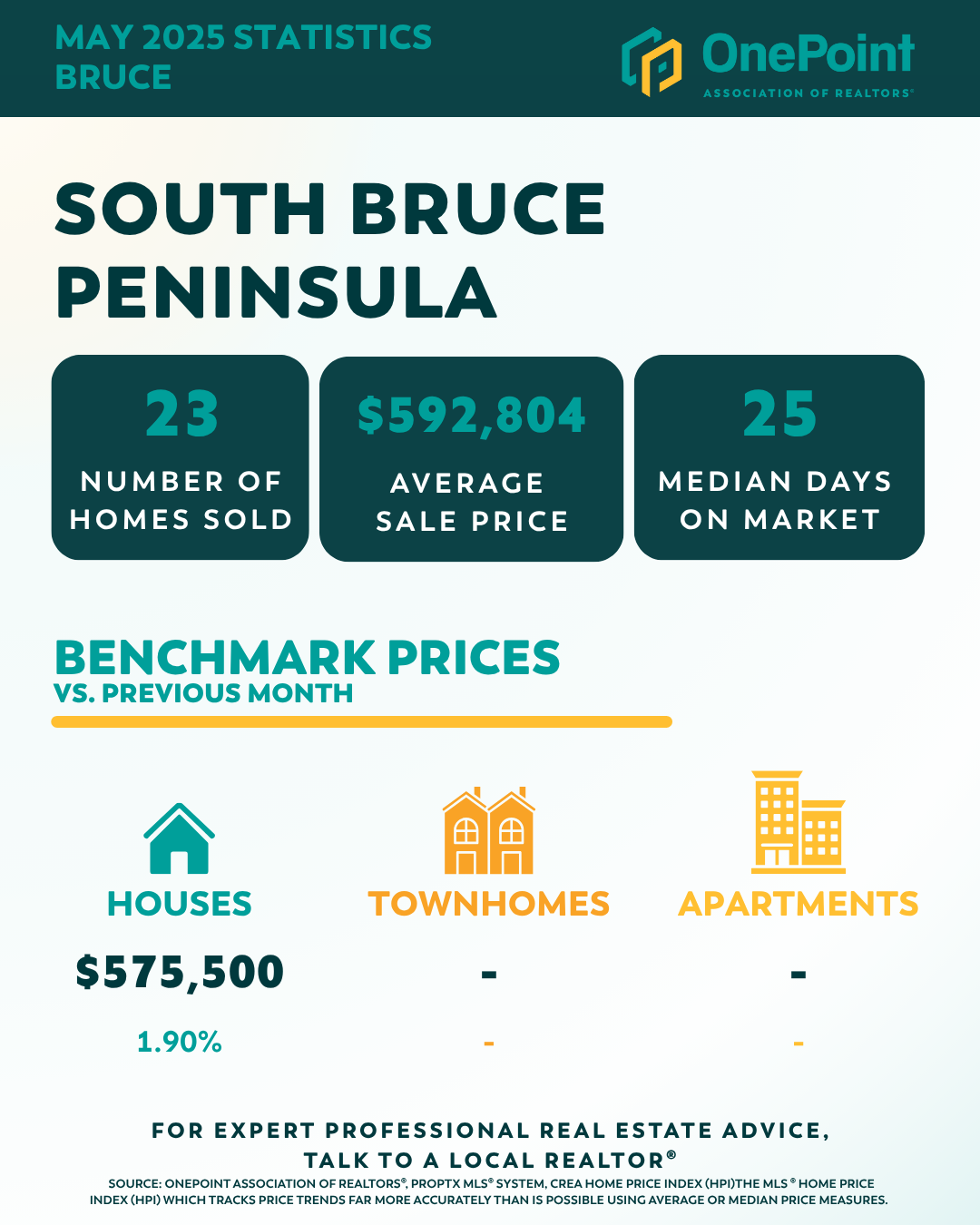

Bruce County Housing Market Update | May 2025

Welcome to the Bruce County Housing Market Update for May 2025! After a period of transition and data refinement, market stats are back and more important than ever for buyers, sellers, and homeowners across our region.

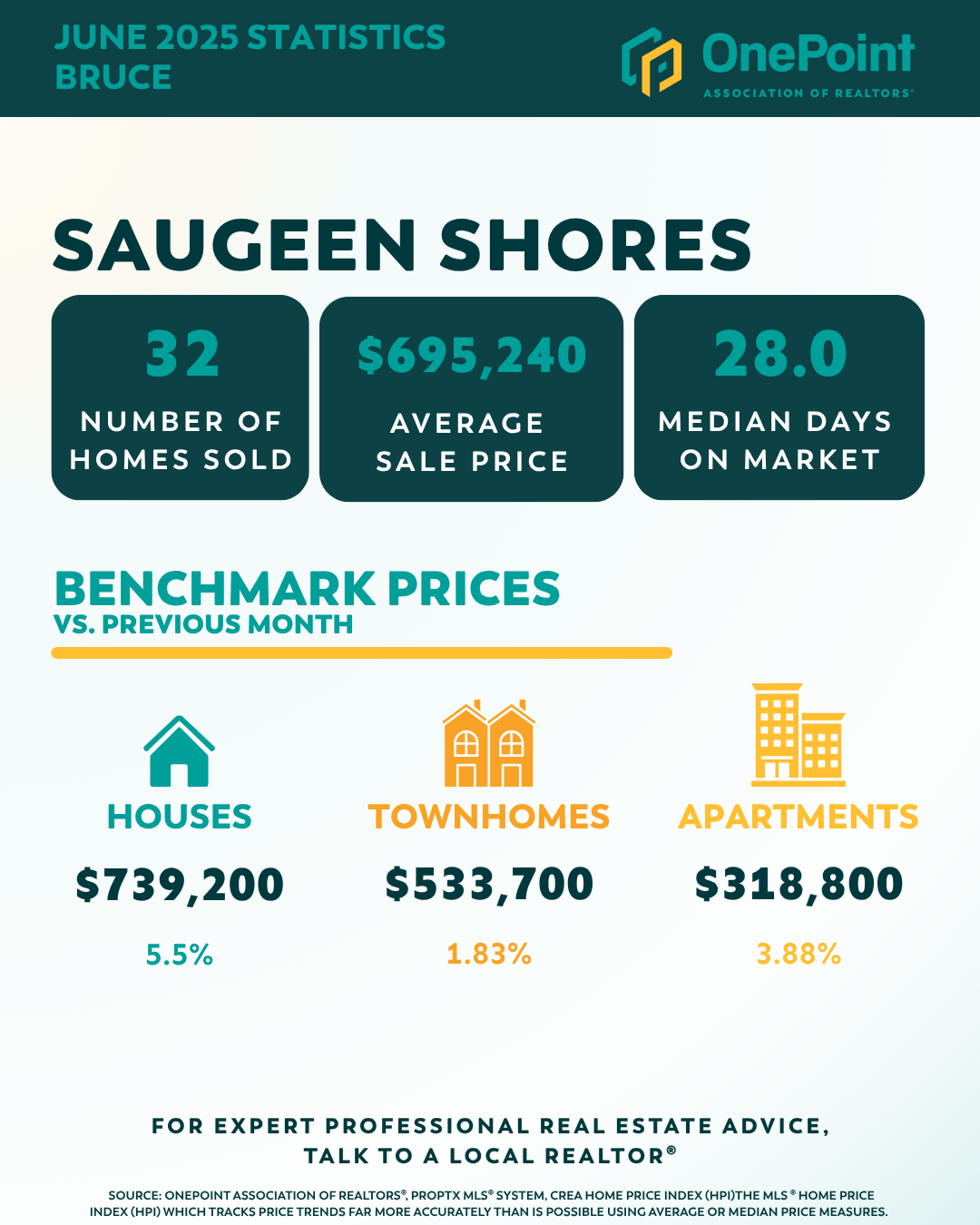

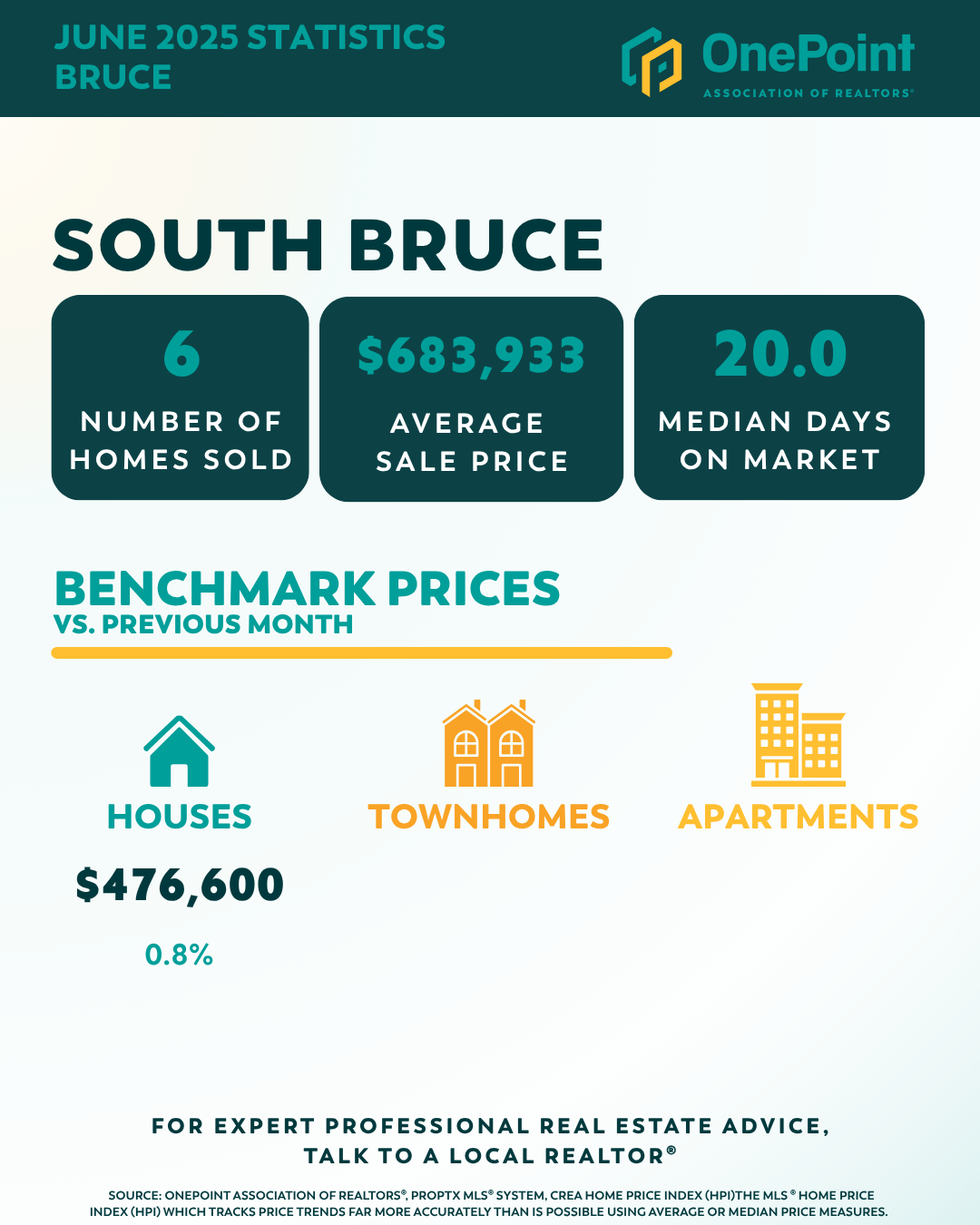

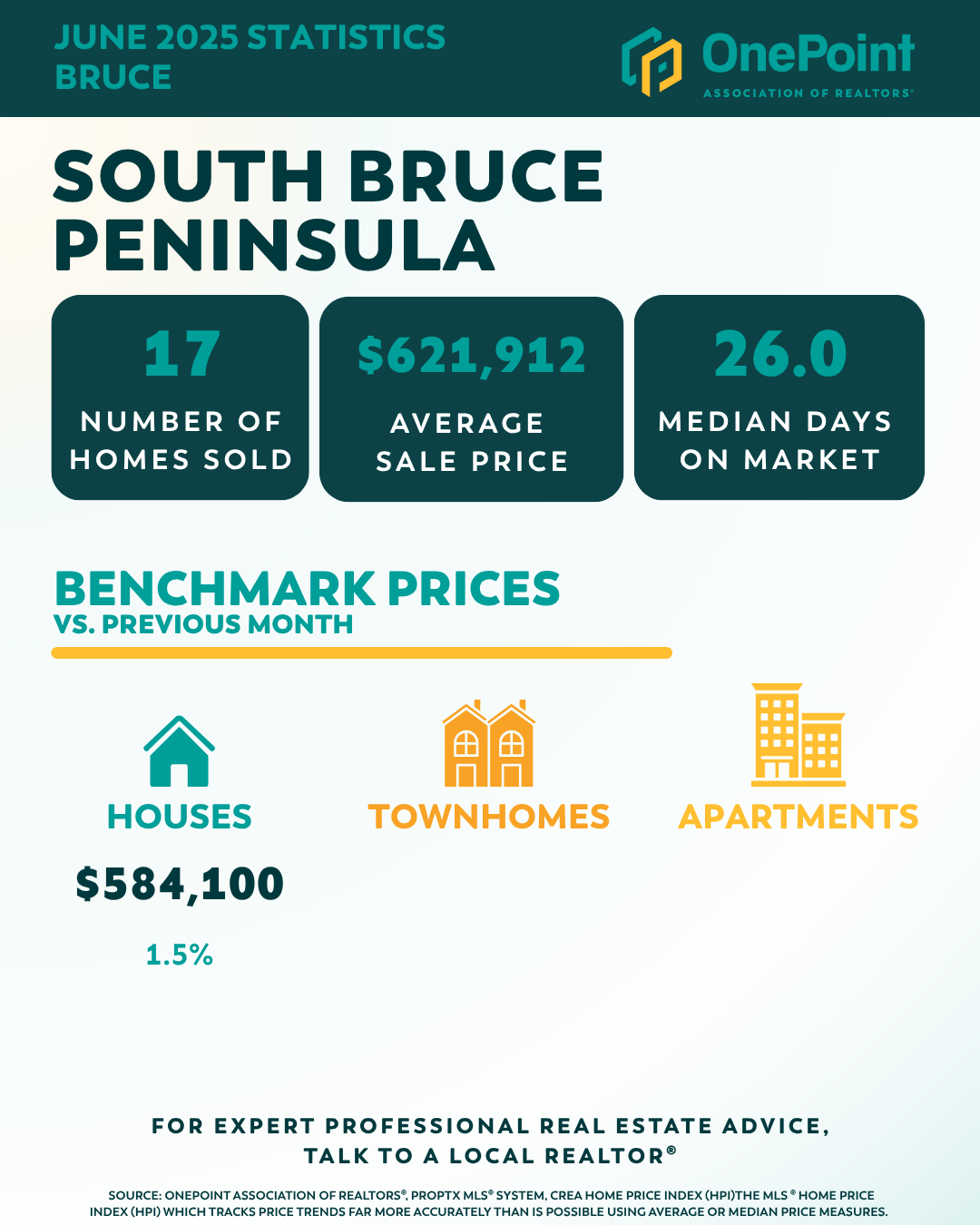

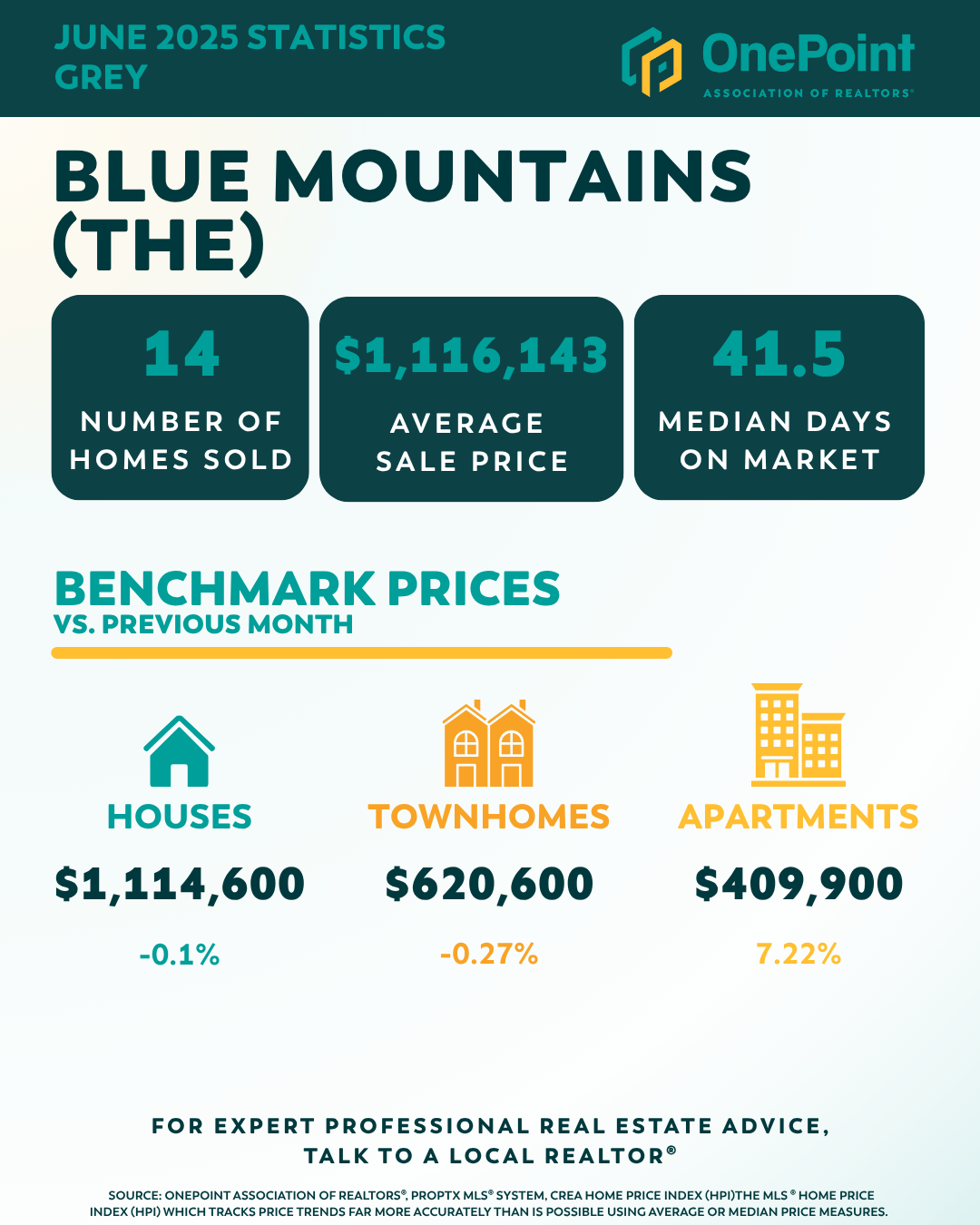

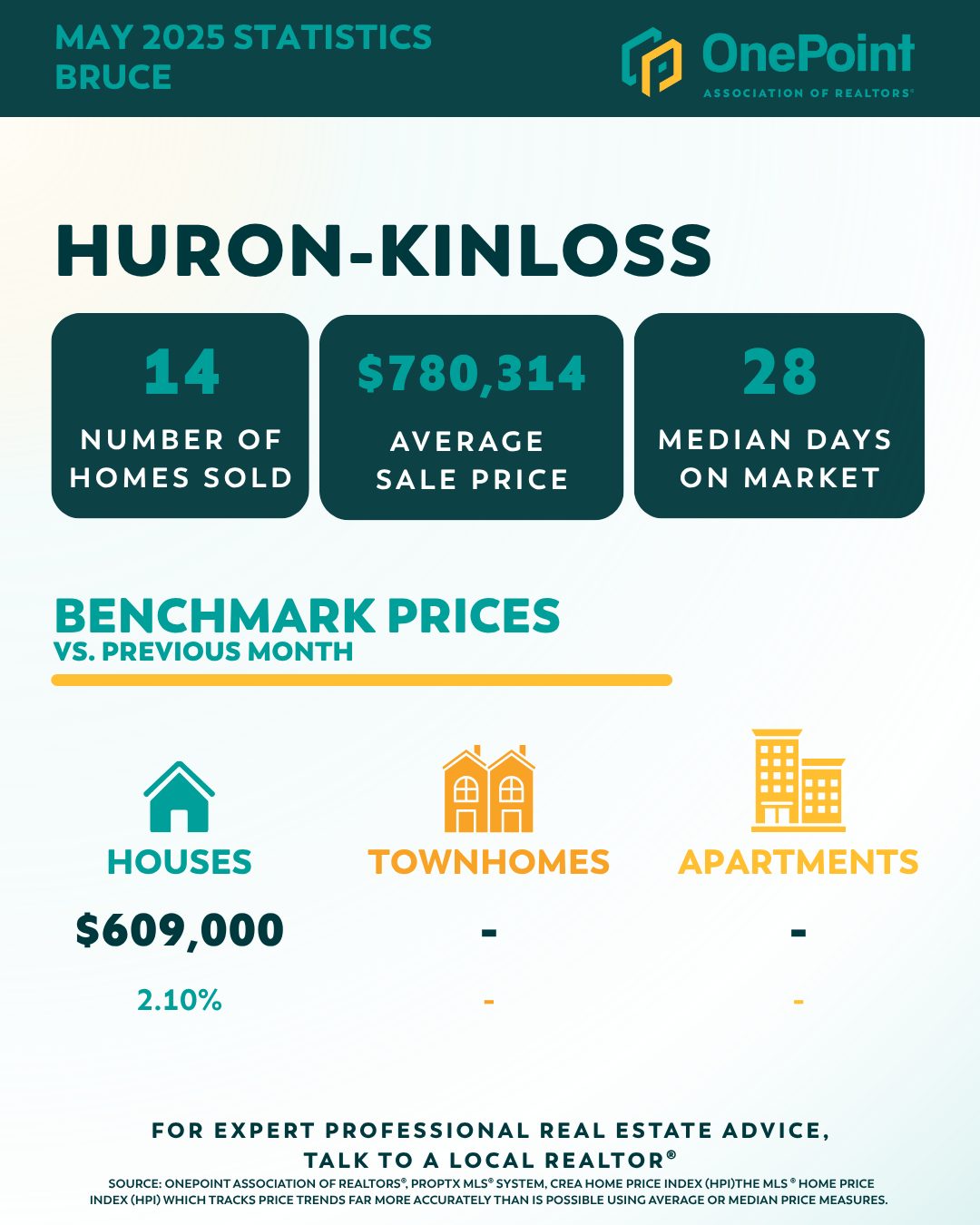

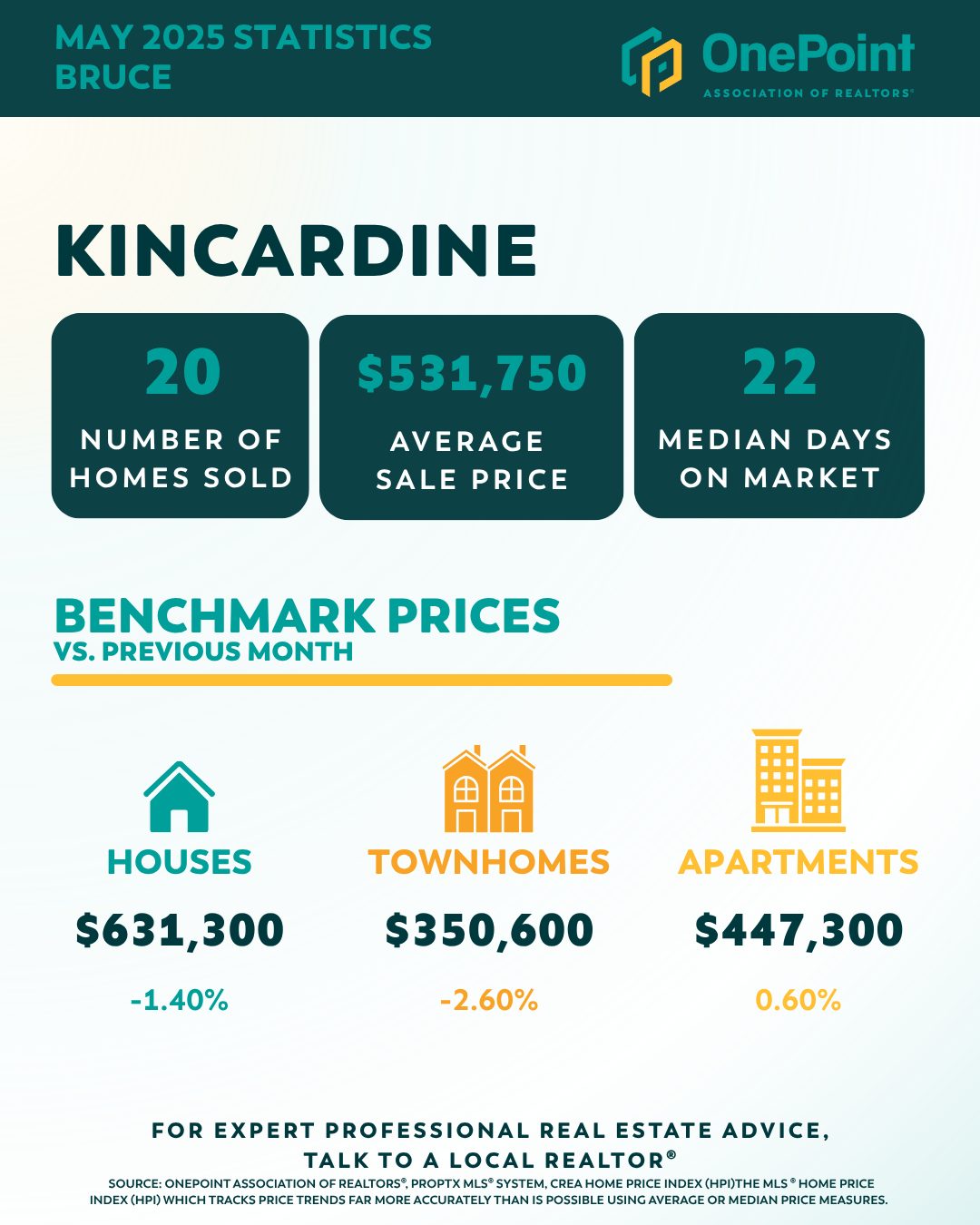

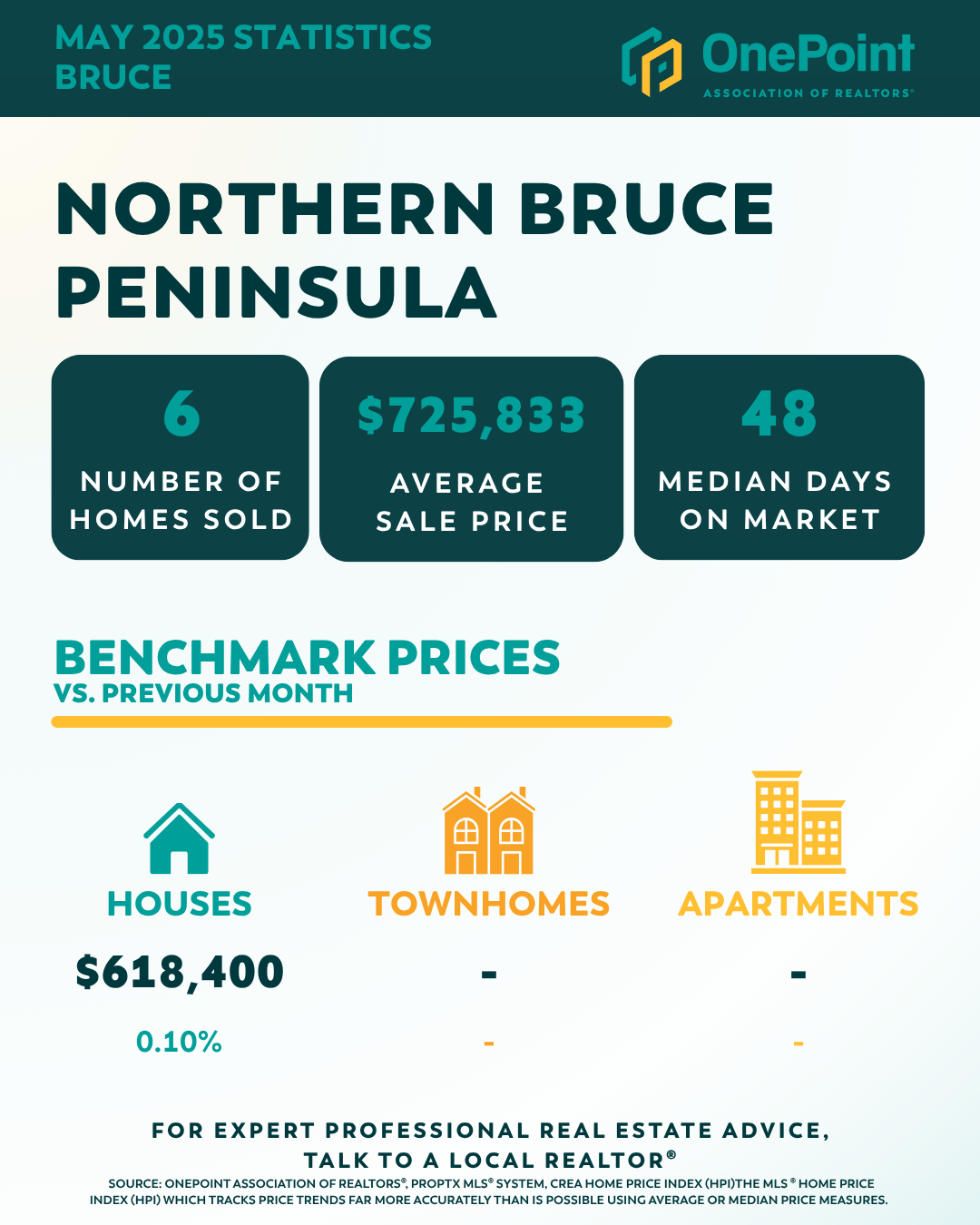

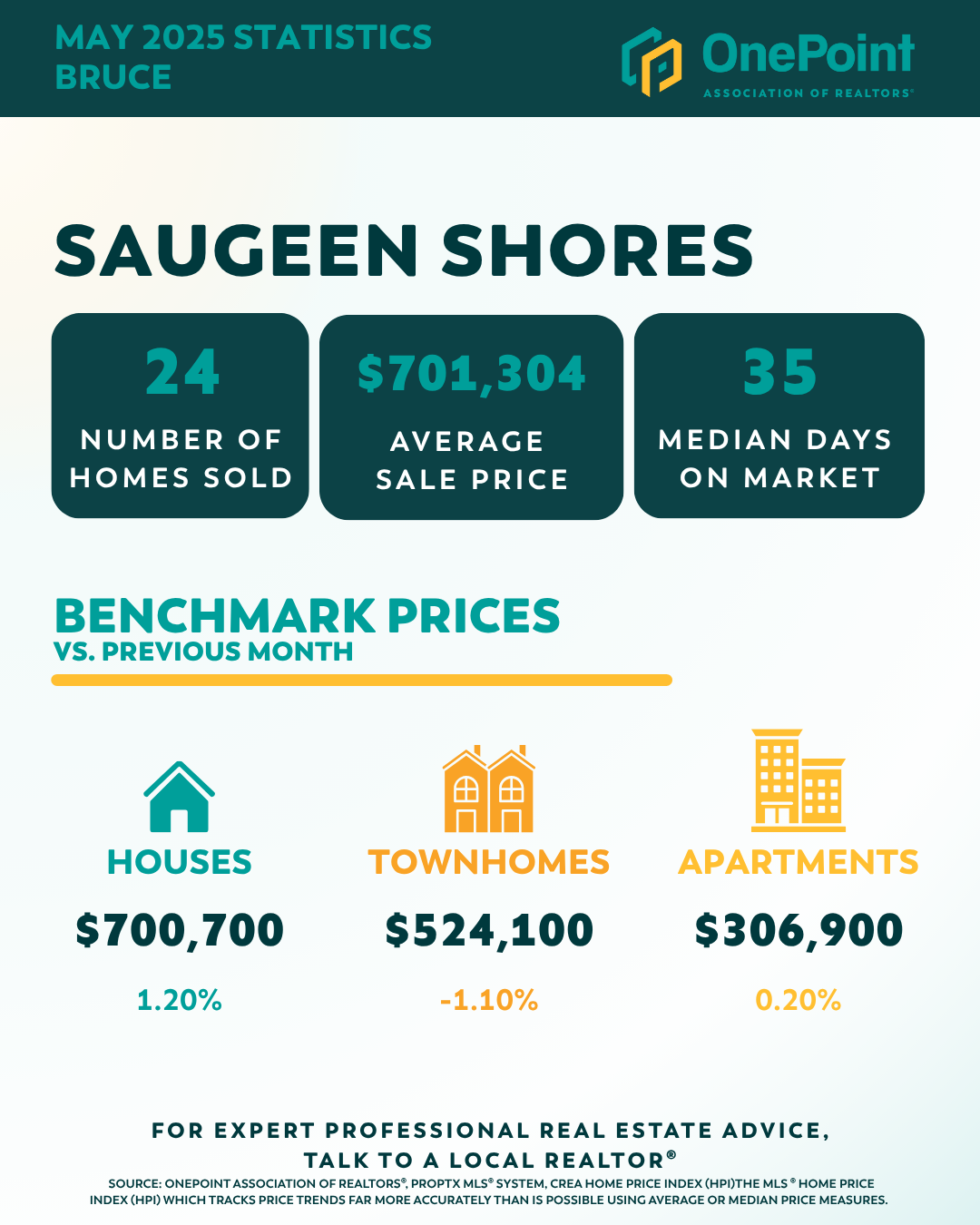

In this post, you’ll find the latest listing stats for Arran Elderslie, Brockton, Huron-Kinloss, Kincardine, Northern Bruce Peninsula, Saugeen Shores, South Bruce, and South Bruce Peninsula. Whether you’re actively in the market or just keeping an eye on local trends, this month’s report will help you make sense of what’s happening in your community and what it could mean for your next move.

Stay tuned for a closer look at home prices, inventory, and days on market in each area, plus practical insights to help you navigate today’s evolving real estate landscape.

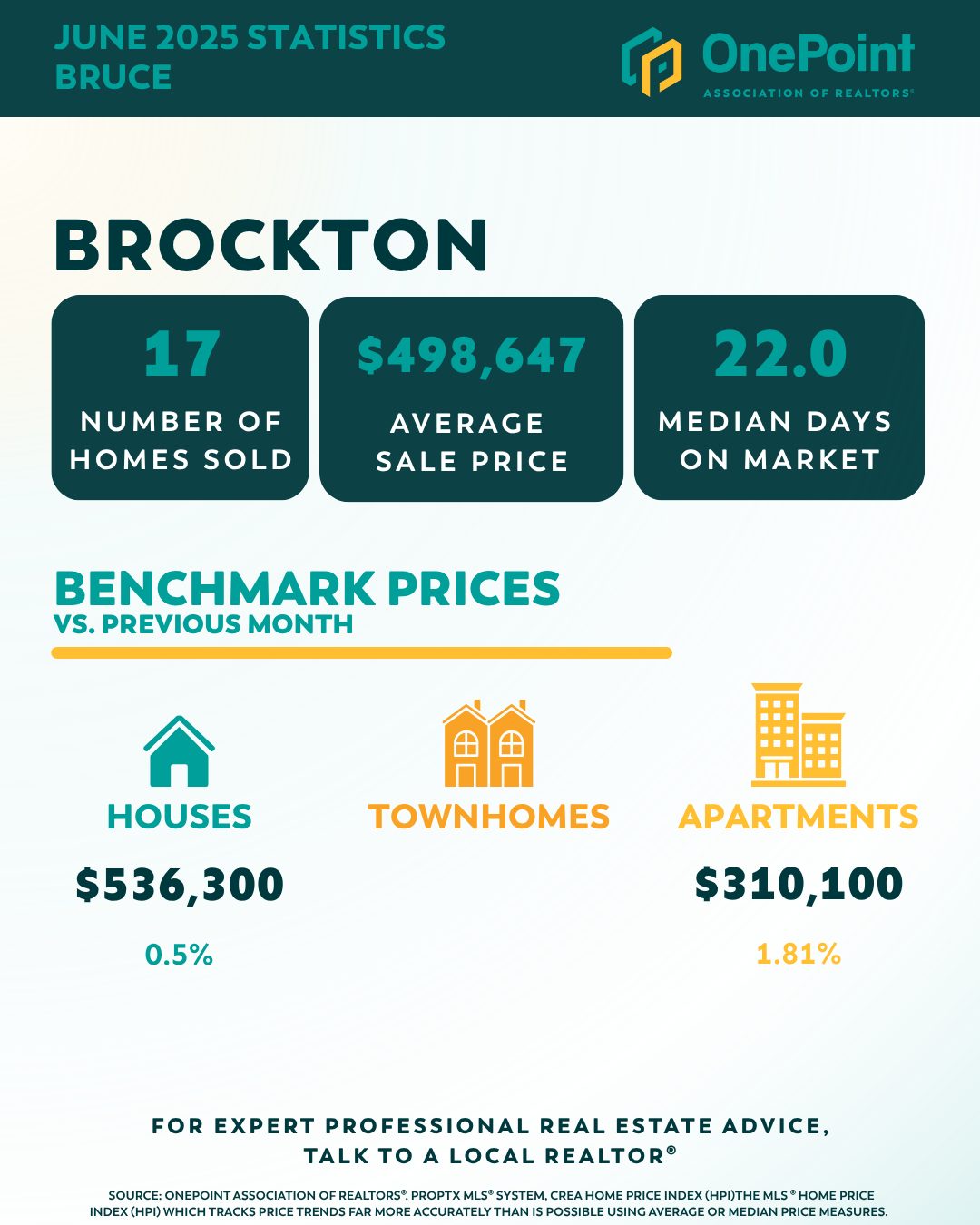

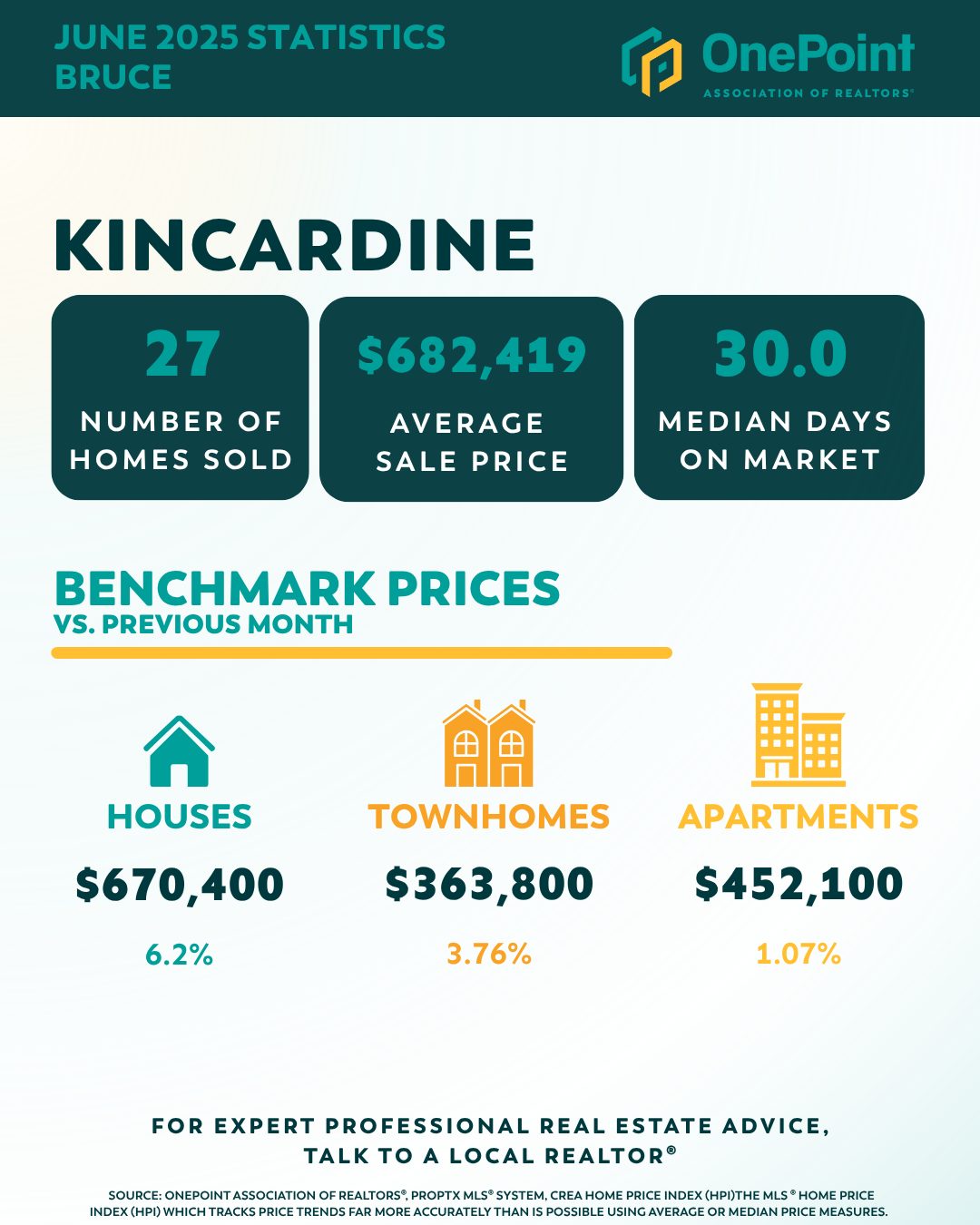

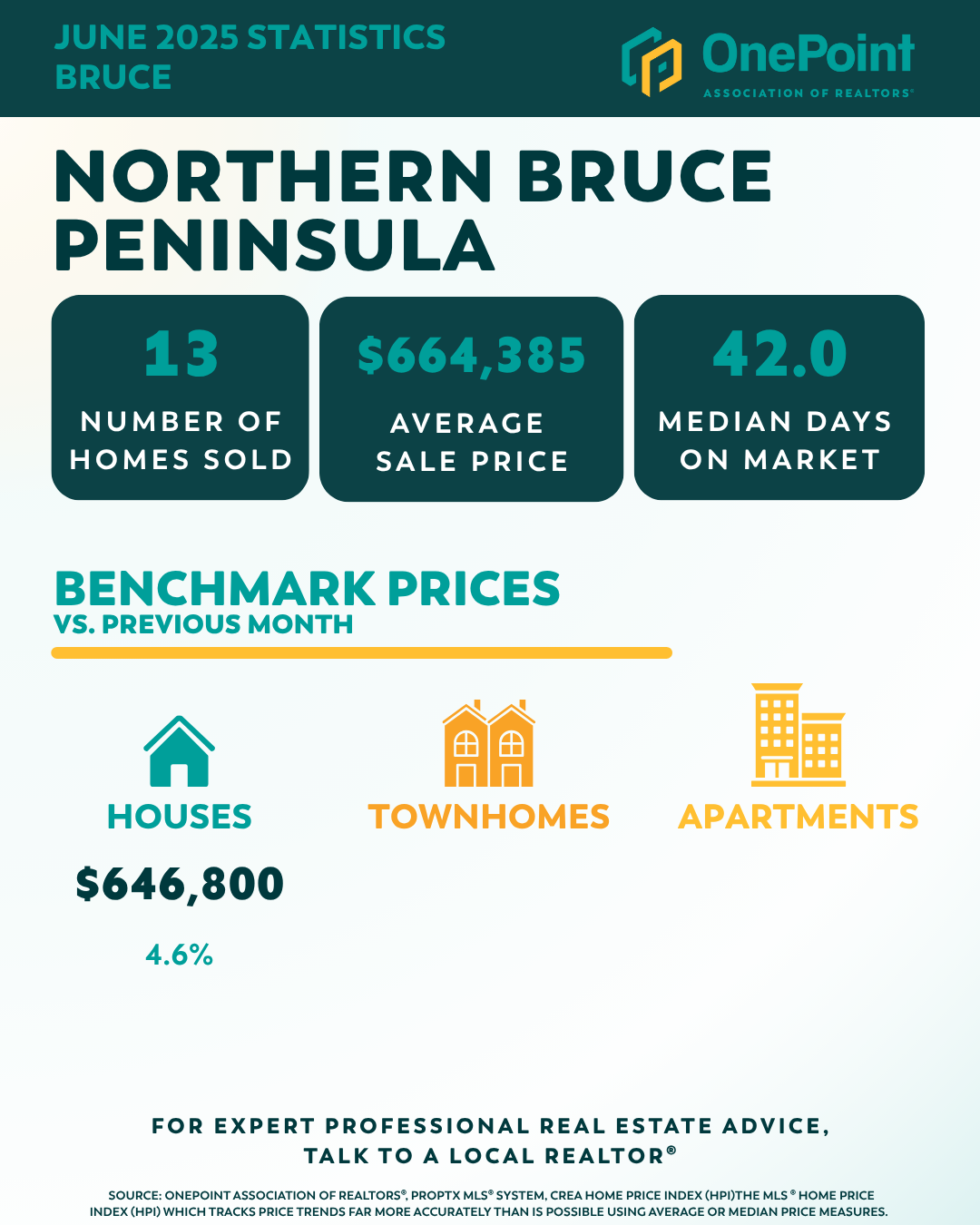

Bruce County Housing Market Update for May 2025

Board & Association Information

OnePoint Association of REALTORS® serves as a unified body representing almost 3,000 real estate professionals across the regions of Huron, Perth, Grey, Bruce, Wellington, Georgian Bay, Simcoe, Parry Sound, Haliburton and Muskoka.

Wondering how these numbers might impact your real estate plans? Whether you’re buying, selling, or just curious about market trends, I’ve got you covered! Let’s navigate the market together! Contact me for a complimentary, no-obligation property valuation!

For more information, contact:

Susan Moffat, REALTOR® with Century 21 In-Studio Realty Inc., Brokerage

519.377.5154

susan.moffat@c21.ca

Interior Painting Tips for a Fresh, Market-Ready Home

A fresh coat of paint is one of the most cost-effective ways to transform your home’s interior, whether you’re preparing to sell or simply want to refresh your space. As a real estate agent, I know that well-executed painting projects can dramatically improve a home’s appeal and value. Here are expert tips to help you achieve professional-looking results.

Plan Before You Paint

- Choose your colours carefully. Neutral tones like soft greys, beiges, and warm off-whites appeal to the widest range of buyers and help rooms feel larger and brighter.

- Test colour samples in your space and observe them at different times of day to ensure you love the look.

- Decide on the right finish: flat or matte hides wall imperfections, while eggshell and satin finishes are more durable and easier to clean.

Prep Like a Pro

- Clear the room or move furniture to the centre and cover with drop cloths. Canvas drop cloths are best—they stay in place and absorb spills better than plastic.

- Remove nails, patch holes, and sand any rough areas for a smooth surface.

- Clean walls thoroughly to remove dust and grime, ensuring paint adheres properly.

Use Quality Tools and Materials

- Invest in high-quality brushes and rollers for a smoother finish and less frustration.

- Mix multiple cans of paint in a large bucket (“boxing”) to ensure colour consistency throughout the room.

- Choose low- or zero-VOC paints for healthier indoor air quality, especially important for families and those with allergies.

Master the Painting Process

- Paint in this order for best results: ceiling, then trim (including baseboards, crown molding, and window/door casings), and finally the walls.

- Maintain a “wet edge” by overlapping each roller stroke with the previous one before the paint dries. This prevents lap marks and streaks.

- For corners and edges, brush first, then immediately roll over with a small roller to match the wall texture.

- Don’t overload or underload your roller—keep it at least half-loaded for even coverage.

Finishing Touches and Clean-Up

- Allow each coat to dry fully before applying the next. Most projects require two coats for optimal coverage and colour depth.

- Remove painter’s tape while the paint is still slightly damp for crisp lines.

- Clean brushes and rollers promptly so they’re ready for your next project.

Bonus Tips for Sellers

- Fresh paint on trim and doors can make a home look new and well cared for—don’t skip these details.

- Stick to universally appealing colours and avoid bold or overly personalized choices when preparing to sell.

- If the job feels overwhelming or your home has high ceilings or intricate details, consider hiring a professional for a flawless finish. (p.s. I can recommend trusted local trades professionals to ensure your project is completed to the highest standard.)

Final Thoughts

A well-painted interior not only makes your home more inviting but also signals to buyers that your property is well maintained. Whether you’re selling soon or just want to enjoy a refreshed space, these tips will help you achieve beautiful, lasting results. Happy painting!

Looking to buy, sell, or invest? As your REALTOR®, I’ll guide you every step of the way. Contact me today to schedule a free consultation and let’s turn your real estate dreams into reality!

For more information, contact:

Susan Moffat, REALTOR® with Century 21 In-Studio Realty Inc., Brokerage

519.377.5154

susan.moffat@c21.ca

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link